Bond Portfolio Trends: Fourth Quarter 2022

South State Correspondent

JANUARY 10, 2023

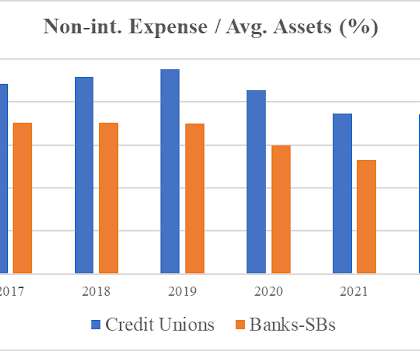

Examining Bond Portfolio Trends: Fourth Quarter 2022. This percentage increase has been trending down in 2022 as moderate loan demand continues and liquidity tightens. The Fed’s hawkish tone has been a consistent theme through 2022 as the focus on inflation reduction has overridden the full employment mandate. tax-free, 6.5%

Let's personalize your content