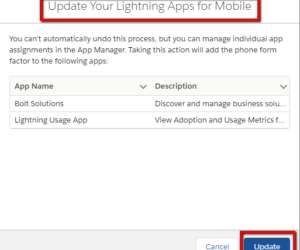

New Salesforce Mobile Application Configure and Customization

Perficient

DECEMBER 9, 2022

New Salesforce Mobile Application Configure and Customization in Salesforce Org. According to reports 120 billion hours are spent with mobile business apps annually. According to Salesforce Every month, almost 2 million users run their business from their phone using the Salesforce mobile app. New mobile navigation bar.

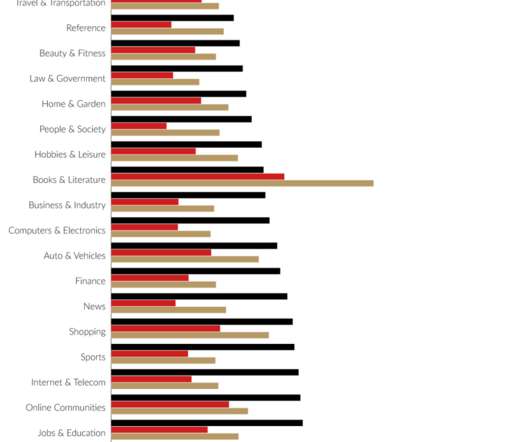

Let's personalize your content