Community Bank Loan Performance Analysis

South State Correspondent

JULY 15, 2024

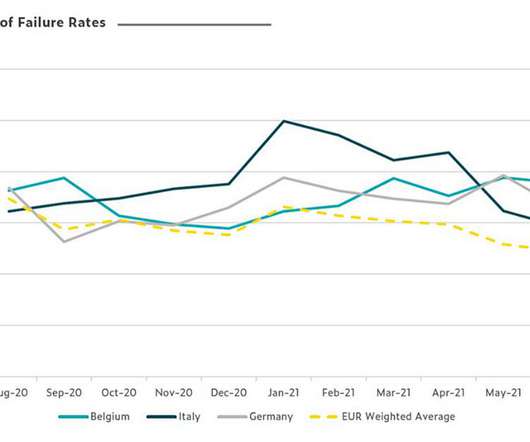

We conducted a loan performance analysis for over 5,000 individual hedged commercial loans originated by almost 400 community and regional banks across the country. Our analysis demonstrates that loan-level hedging has offered community banks a strong competitive advantage in the current interest rate environment and competitive landscape.

Let's personalize your content