FlexWage wins EWA carve-out in Connecticut

Payments Dive

JANUARY 5, 2024

The earned wage access company said the Connecticut Department of Banking determined it doesn’t need a state lending license.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Connecticut Related Topics

Connecticut Related Topics

Payments Dive

JANUARY 5, 2024

The earned wage access company said the Connecticut Department of Banking determined it doesn’t need a state lending license.

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

CFPB Monitor

MAY 4, 2022

Connecticut is the next in a growing list of states to pass comprehensive data privacy legislation. Last Friday, the Connecticut legislature passed, by large margins, Senate Bill 6 — which we are referring to as the Connecticut Data Privacy Act (CTDPA). The law now awaits the Governor’s signature. No Rule Making Authority.

Payments Dive

MAY 16, 2024

The warning comes as states and the federal government weigh options for regulating earned wage access products.

CFPB Monitor

SEPTEMBER 20, 2023

The Connecticut Department of Banking (the “Department”) issued a guidance letter on September 11, 2023 (the “Guidance”) providing its position regarding the amendments to Connecticut’s Small Loan Lending and Related Activities Act (the “Act”) that become effective on October 1, 2023. We previously blogged about these amendments here.

American Banker

APRIL 17, 2024

Banking Circle US is the first company to use Connecticut's uninsured bank charter for wholesale and merchant activities. This kind of charter makes sense for payments firms, but questions persist about overall viability.

CFPB Monitor

JULY 29, 2022

On July 20, 2022, the Connecticut Department of Banking (the “Department”) issued a Consumer and Industry Advisory on Money Transmission (the “Advisory”). The definition of money transmission was further broadened in 2018 when Connecticut amended its money transmitter statute to encompass transmission activities involving virtual currency.

PYMNTS

JANUARY 14, 2021

Connecticut Attorney General William Tong is launching an antitrust probe into how Amazon runs its eBook business, the Wall Street Journal (WSJ) reported on Thursday (Jan. Connecticut’s inquiry is just the latest antitrust probe by several state and federal authorities into how Amazon conducts its business.

PYMNTS

SEPTEMBER 23, 2020

Like all the towns on the Connecticut shoreline, Guilford is centered around a village green. On its north side stands a picture-postcard, white-steepled church. To the east is another church and spire, this one made of carved granite taken from the local quarries.

BankDeals

JULY 24, 2020

Connecticut Community Bank, N.A. is currently offering an 18-month CD with the highest rate in Connecticut. Minimum opening deposit is $500. Also available as an IRA CD.

CFPB Monitor

MAY 19, 2022

The Order also directs SoLo to stop enforcing loans made to Connecticut residents and make restitution of any amounts it obtained in connection with such loans together with interest. Some Connecticut borrowers were assessed a late fee equal to 15% of the principal loan amount, which was generally split equally between the lender and SoLo.

PYMNTS

SEPTEMBER 30, 2016

28) said Connecticut is preparing for a new statute to legalize payroll cards. Connecticut is also ensuring that, while payroll cards can expire, the funds loaded onto them cannot, and lost cards can be replaced once a year when an employee makes such a request. Reports on Wednesday (Sept. The statute comes into effect Oct.

CFPB Monitor

JULY 5, 2023

On June 29, 2023, Connecticut’s Governor signed into law Substitute Senate Bill No. 1033 which makes significant changes to the state’s Small Loan Act. The new law takes effect on October 1, 2023. The primary changes are as follows: New APR calculation (Section 1, subdivision (2), Revising 36a-555(2)).

PYMNTS

JUNE 24, 2020

With coronavirus infection rates soaring in the Sunbelt, the governors of New York, Connecticut and New Jersey are teaming up to slap a 14-day quarantine on travelers from states where the deadly virus is spiking. Phil Murphy and Connecticut Gov. New York Gov. Andrew Cuomo, New Jersey Gov.

CFPB Monitor

JULY 2, 2021

The order applies to individuals working on behalf of persons licensed in Connecticut as: Consumer collection agencies; Debt adjusters; Debt negotiators; Mortgage brokers, mortgage correspondent lenders or mortgage lenders; Mortgage servicers; Sales finance companies; Small loan companies; and.

CFPB Monitor

MAY 24, 2023

and Connecticut relating to its practice of requesting tips and donations in connection with the loans offered through its platform. A fintech peer-to-peer lender has entered into separate consent orders with California, Washington D.C.,

American Banker

JUNE 2, 2024

Numisma, a Connecticut-chartered uninsured bank, was granted a Federal Reserve master account last week — the first bank with a novel charter to do so since the Fed issued its master account guidelines in 2022. Whether others can do the same is an open question.

American Banker

FEBRUARY 8, 2024

It's early days in the Connecticut bank's testing of Cascading AI, but one clear benefit has emerged: The software can handle the many inquiries that come in on Friday nights, after loan officers have gone home.

American Banker

JANUARY 23, 2024

But Connecticut-based Webster is bullish based on its pipeline of nonoffice commercial real estate, public finance and other credits, CEO John Ciulla says. Several regional banks have projected minimal growth or even a decline in lending this year.

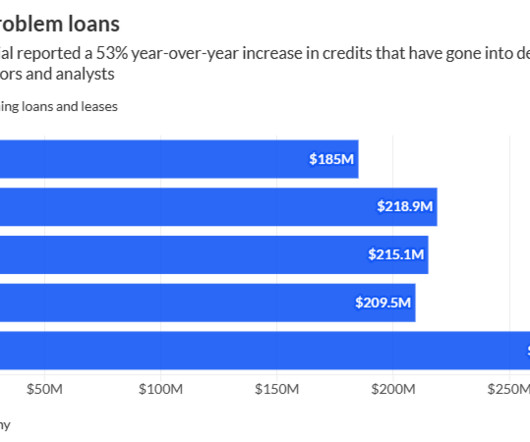

American Banker

APRIL 23, 2024

The Connecticut bank —a regional traditionally regarded as a cautious lender — said nonperforming loans and leases rose 53% year-over-year. The uptick was in mostly the commercial-and-industrial loan space, although there was one nonperforming commercial real estate loan, executives said.

CFPB Monitor

NOVEMBER 6, 2023

On November 2, 2023, the Consumer Financial Protection Bureau issued a report on the community reinvestment laws of seven states (Connecticut, Illinois, Massachusetts, New York, Rhode Island, Washington, West Virginia), and the District of Columbia that evaluate the record of state-chartered financial institutions and other lenders in meeting the credit (..)

CFPB Monitor

APRIL 11, 2022

A Connecticut federal district court has refused to dismiss claims filed by the CFPB against a mortgage company and three of its principals for alleged Truth in Lending Act (TILA), Mortgage Act and Practice (MAP) Rule, and Consumer Financial Protection Act (CFPA) violations.

American Banker

DECEMBER 15, 2023

The Connecticut bank agreed to pay $350 million to acquire Ametros Financial, a custodian and administrator of medical funds from insurance claim settlements. Some analysts see the deal as a signal that Webster does not plan to sell its health savings account business, which has been the subject of recent speculation.

Perficient

FEBRUARY 26, 2021

The fact that the increase in New York is based upon inflation data from New Jersey, Connecticut and Pennsylvania seems a bit of a stretch, but is likely based on the challenge of collecting accurate inflation data by state. The increase is permitted under Part 400.11 Interestingly, New Jersey has a different percentage.

PYMNTS

AUGUST 13, 2020

We have ended relationships with some partners and Amazon is working closely with all impacted drivers to ensure they find opportunities to deliver Amazon packages with other local Delivery Service Partners with little to no disruption to pay,” an Amazon spokesperson told CNBC.

American Banker

DECEMBER 28, 2022

(..)

BankDeals

SEPTEMBER 3, 2020

Collinsville Bank's Kasasa Cash offers a competitive rate and is available statewide in Connecticut and in three Massachusetts counties.

PYMNTS

MAY 7, 2020

The highest insured unemployment rates in the week ending April 18 were in Vermont (25.2), West Virginia (21.9), Michigan (21.7), Rhode Island (20.4), Nevada (19.9), Connecticut (18.7), Puerto Rico (17.9), Georgia (17.3), New York (17.2) Seven states reported there were 52,305 claims for Pandemic Emergency Unemployment Compensation.

American Banker

AUGUST 15, 2021

(..)

PYMNTS

DECEMBER 28, 2020

Headquartered in Stamford, Connecticut, and privately held, cxLoyalty said it serves some 70 million people across 19 countries. He added in the statement that he anticipates the transition will go smoothly and noted that the company’s staff "worked tirelessly to achieve this milestone.”.

American Banker

AUGUST 1, 2022

(..)

American Banker

NOVEMBER 23, 2022

(..)

Banking Exchange

AUGUST 17, 2020

Individuals without access to basic banking services can now open accounts through a state-wide initiative being rolled out across Connecticut Community Banking People Covid19 Customers Fair Lending Feature3 Feature.

PYMNTS

JUNE 23, 2020

However, it will now start on July 16 of next year in Connecticut at the Mohegan Sun Arena and will conclude at the Hollywood Bowl on Oct. Tickets bought in the past can be used for the revised dates, or those who aren’t able to go can seek a reimbursement. The tour was first set for July to September of this year.

American Banker

NOVEMBER 15, 2021

(..)

American Banker

NOVEMBER 21, 2022

(..)

American Banker

AUGUST 25, 2022

(..)

American Banker

MAY 11, 2016

First Connecticut Bancorp in Farmington has committed to making $5 million in small-business loans over the next year.

PYMNTS

JANUARY 14, 2021

In today’s top news, Connecticut’s Attorney General has opened an antitrust probe into Amazon’s eBook business, and Petco beat expectations in its IPO. Connecticut AG Launches Antitrust Probe Into Amazon’s eBook Business. Plus, Grab Financial raised $300 million.

American Banker

SEPTEMBER 19, 2022

(..)

Abrigo

JUNE 27, 2023

Subsequent orders expanded the metropolitan watch areas, and this latest order includes Litchfield County in Connecticut and Adams, Arapahoe, Clear Creek, Denver, Douglas, Eagle, Elbert, El Paso, Fremont, Jefferson, Mesa, Pitkin, Pueblo, and Summit counties in Colorado.

BankDeals

AUGUST 6, 2020

Millbury National Bank's Kasasa Cash and Kasasa Saver are available in Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont.

PYMNTS

OCTOBER 9, 2018

The New York Attorney General and the Connecticut Attorney General are investigating the Google data breach that may have exposed the private data of at least 500,000 users. Google announced Monday (October 8) that it is shutting down Google+ after finding a security bug that made the data accessible to developers.

CFPB Monitor

APRIL 23, 2020

Massachusetts , New Jersey , Connecticut , and Illinois have announced that they are participating in a multi-state initiative to provide relief to borrowers whose student loans are not covered by the CARES Act through agreements with certain student loan servicers.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content