Warren probes Zelle scam policy

Payments Dive

FEBRUARY 21, 2024

Three senators, including Elizabeth Warren, asked Zelle owner Early Warning Services to provide detailed information about its fraud reimbursement policy.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Policies Related Topics

Policies Related Topics

Payments Dive

FEBRUARY 21, 2024

Three senators, including Elizabeth Warren, asked Zelle owner Early Warning Services to provide detailed information about its fraud reimbursement policy.

Abrigo

SEPTEMBER 5, 2023

When and how to cite credit exceptions A policy on credit exceptions can address many factors that can lead financial institutions to diverge from loan policy and miss signs of potential trouble. Takeaway 3 A credit exception policy should spell out what one is, when it can be used, and how to clear it.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

Abrigo

MAY 2, 2022

Confident Risk Management Begins with Sound Loan Policy A risk-based approach to loan policy can effectively improve your institution's profitability. You might also like this webinar on loan policy best practices. Loan policies make up the foundation for managing that credit risk. . When and how to update your policy.

Payments Dive

NOVEMBER 23, 2022

The payments company’s board adopted the executive severance policy this week even though it opposed a similar shareholder proposal in May.

Advertisement

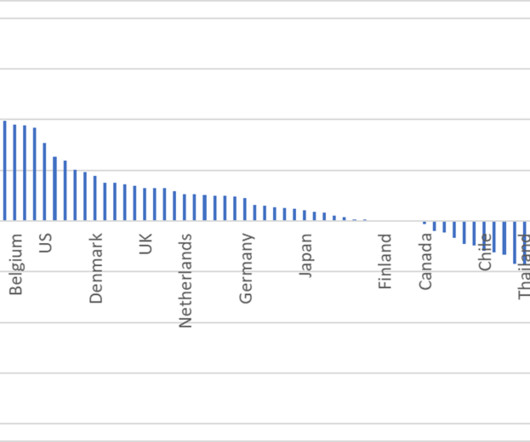

In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers.

BankUnderground

OCTOBER 4, 2023

Julia Giese, Michael McLeay, David Aikman and Sujit Kapadia Central banks have been using a range of monetary policy and macroprudential tools to maintain monetary and financial stability. Financial crises and macroprudential policy The global financial crisis of 2007–08 highlighted major deficiencies in macrofinancial policy frameworks.

BankUnderground

MARCH 28, 2024

In our recently published Staff Working Paper , we ask how monetary policy should be conducted amid, what has been referred to as, a ‘battle of the markups’. We find that countercyclicality in aspired price markups (‘sellers’ inflation’) calls for more dovish monetary policy.

Payments Dive

APRIL 11, 2019

The move by Amazon to reverse policies for its cashierless Amazon Go stores is being seen as a response to growing economic and political pushback against the impact of Silicon Valley on major segments of U.S. and global societies.

BankUnderground

DECEMBER 20, 2023

Daniel Albuquerque and Jamie Lenney Rent prices have risen by 9% on average in England since the Bank of England’s Monetary Policy Committee (MPC) started raising interest rates in December 2021. Is monetary policy causing the rise in rents? So is there any evidence that monetary policy is pushing up rental prices in the UK?

PYMNTS

SEPTEMBER 22, 2019

While the company had rolled back the policy in April, it has decided to reinstate collecting the initial 2.9 Earlier this year, PayPal updated its User Agreement to change our refund policy,” a PayPal spokesperson told The Verge. “In The policy change is going into effect beginning on Oct. 11, 2019.”. “We

Payments Dive

OCTOBER 18, 2023

The new council is tasked with providing “strategic guidance” to the San Francisco-based card giant’s Washington think tank, but none of the initial members are based in the U.S.

PYMNTS

JANUARY 21, 2021

The European Central Bank (ECB) held this year’s first monetary policy meeting, and said in a statement on Thursday (Jan. The central bank’s governing council said that Eurozone interest rates will stay at record lows, as would other policies instituted during the pandemic. percent.

CFPB Monitor

APRIL 7, 2023

In the CFPB’s second attempt to define “abusive” acts or practices, the first being guidance rescinded a year after it was given in 2020, the CFPB has issued a new policy statement in which it turns to statutory analysis and past enforcement actions to provide a framework for determining what constitutes abusive conduct. . Continue Reading

BankUnderground

JULY 13, 2022

Policy, meanwhile, was pulled in multiple directions by multiple objectives – employment, price and financial stability and debt sustainability. Asking what role macroeconomic policy played in interwar Britain is not a new topic, so why revisit it? What do I do?

BankUnderground

JUNE 1, 2023

Sangyup Choi, Tim Willems and Seung Yong Yoo How does monetary policy really affect the real economy? What kinds of firms or industries are more sensitive to changes in the stance of monetary policy, and through which exact channels? ’), which is why we are interested in creating a broad database of such shocks.

PYMNTS

JUNE 10, 2020

TikTok , the popular Chinese short-form mobile video app, is facing more scrutiny over its privacy policies, Bloomberg reported. Last month, the data-protection commission in the Netherlands opened an investigation into TikTok’s policies to protect children’s data, noting the app is popular with Dutch youth, Bloomberg reported.

The Paypers

JULY 8, 2024

Network International has announced its partnership with Policy Bazaar in order to enable merchants and traders to access affordable insurance easily and securely.

American Banker

MAY 19, 2024

Community banks are in the early days of experimenting with AI and the earlier days of writing policies to govern its usage. It's key to do both at once.

PYMNTS

APRIL 9, 2020

Amid millions lost in box office receipts and production costs due to the coronavirus pandemic, Hollywood studios are now aiming to collect on their insurance policies. The insurance industry provides policies that protect studios from unforeseen circumstances.”.

BankUnderground

AUGUST 18, 2022

Since 2009, when policy rates reached their effective lower bound, quantitative easing (QE) has become an important instrument of central bank monetary policy. These models allow us to decompose movements in the curve into two effects: policy rate expectations; and term premia. Iryna Kaminska and Haroon Mumtaz. What we find.

BankUnderground

FEBRUARY 11, 2021

So can recipient countries employ prudential policies to offset monetary policy changes in centre countries? In line with those observations, we uncover evidence of a ‘London Bridge’ in cross-border lending: the way French banks channel funds to the UK is responsive to prudential policies in the rest of the world.

Bank Innovation

FEBRUARY 8, 2018

EXCLUSIVE—Payment processor Visa has not changed any policies related to the purchasing of bitcoin, the company told Bank Innovation. The company still allows Visa cardholders to make cryptocurrency purchases with “credit, debit, and certain prepaid Visa products,” it said in a statement.

Payments Dive

FEBRUARY 27, 2024

The senator urged regulators to block the deal and took the OCC to task for its approval record. Meanwhile, JPMorgan CEO Jamie Dimon advocated for Capital One to get a fair shake.

South State Correspondent

DECEMBER 14, 2020

With FDA approval and the first shipments of the COVID-19 vaccine start to hit our communities this week, the question comes up over should banks have a policy around if the vaccine should be mandated, recommended, supported, and acknowledged in the workplace?

TheGuardian

DECEMBER 26, 2023

Campaign at leading universities such as Oxbridge and UCL warns lender it will miss out on top talent if it finances fossil fuels Hundreds of students from leading UK universities have launched a “career boycott” of Barclays over its climate policies, warning that the bank will miss out on top talent unless it stops financing fossil fuel companies.

Chris Skinner

AUGUST 5, 2018

Also released last week, the EU document has a different focus to the US one, which allowed national FinTech charter bank licenses to be … The post The EU’s policy on FinTech competition is … appeared first on Chris Skinner's blog.

PYMNTS

JANUARY 14, 2021

The apps that were found to violate our user safety policies were immediately removed from the Store, and we have asked the developers of the remaining identified apps to demonstrate that they comply with applicable local laws and regulations,” Google India said in a Thursday (Jan. 14) blog post. “In

PYMNTS

JANUARY 22, 2020

With the new IBM Policy Lab, IBM is looking to regulate artificial intelligence (AI) development in a way that is safe, but does not infringe upon the creation of new technology, reports said. The think tank will gather leaders in several fields — from public policy, academia, civil society and technology. The Policy Lab will be busy.

ABA Community Banking

MARCH 22, 2024

ABA's Hu Benton discusses what bankers need to know about potential deals and offers amid the wave of policy changes. The post Understanding the emerging bank M&A policy landscape appeared first on ABA Banking Journal.

PYMNTS

JANUARY 29, 2021

New policy changes on Google Play will enable gambling apps to be available in its store in more countries effective March 1, extending availability to the U.S. Google Play is further updating its policies to allow global developers the ability to create sustainable businesses that keep consumer safety in mind.

BankUnderground

OCTOBER 26, 2021

The Bank of England co-organised a ‘ History and Policy Making Conference ‘ in late 2020. History offers policymakers and academics useful case studies that can serve as distant mirrors beyond the study of crises and policy responses to them. Monetary theory and policy in Medieval France. Nathan Sussman.

The Paypers

JULY 18, 2024

The three European Supervisory Authorities (RBA, EIOPA, and ESMA – the ESA) have published a new batch of policy products under the Digital Operational Resilience Act (DORA).

ABA Community Banking

DECEMBER 8, 2023

The post Podcast: The bank policy outlook for 2024 appeared first on ABA Banking Journal. From the Basel III endgame to Regulation II to new Community Reinvestment Act and Section 1071, 2023 has delivered a regulatory onslaught for the industry. How are bankers navigating the waves of overlapping changes?

PYMNTS

SEPTEMBER 17, 2020

In notes on its most recent (August) meeting of the bank’s Payments System Board, the members said that “at present there is not a strong public-policy case for issuance in Australia, given that the electronic payments system in Australia compares very favorably with those in many other countries and access to cash remains good.”.

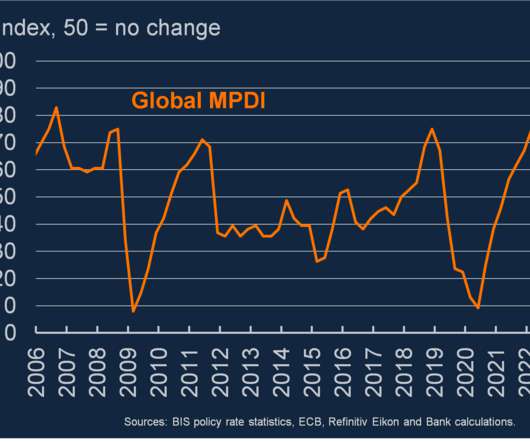

BankUnderground

OCTOBER 6, 2022

Occasionally, economic shocks are global in nature and so monetary policy can move in tandem across the world. But how common have directional changes in monetary policy been across the world over recent decades? To answer this, we developed a monetary policy diffusion index (MPDI) to illustrate the breadth of monetary policy changes.

PYMNTS

AUGUST 7, 2020

Microsoft and Facebook are grumbling publicly about fellow tech giant Apple ‘s policies restricting access to coveted slots in its App Store, as well as the access given to iPhone and iPad users. 15, Microsoft plans to release Project xCloud , a streaming service that will allow users to play any of roughly 100 games.

BankBazaar

AUGUST 3, 2020

The most important difference between these two insurance plans is that while Corona Kavach policy is an indemnity-based plan in that only the insurer will only reimburse your hospital bill, the Corona Rakshak policy on the other hand, is a benefit-based plan where the insurer will pay 100% of the sum assured to the policyholder.

CFPB Monitor

OCTOBER 6, 2022

The CFPB, in a notice published in the Federal Register on September 27, 2022 , announced that it was rescinding its No-Action Letter and Compliance Assistance Sandbox policies (Policies). The CFPB also determined that the existing Policies failed to meet appropriate standards for transparency and stakeholder participation.

BankUnderground

FEBRUARY 8, 2022

Could the slow response of deposit rates to changes in monetary policy strengthen its impact on the economy? At first look, the answer would probably be ‘no’ Imperfect pass-through of policy to deposit rates means that the rates on a portion of assets in the economy respond by less than they could. Alberto Polo.

BankUnderground

JULY 27, 2021

This fact has motivated a large body of literature to assess the role that macroprudential (MacroPru) policies play in mitigating the severity of recessions. In reality, this policy often takes the form of minimum capital or liquidity requirements. Policy implications. This probability is about 1.1

BankUnderground

AUGUST 17, 2021

There is ample evidence that a monetary policy tightening triggers a decline in consumer price inflation and a simultaneous contraction in investment and consumption (eg Erceg and Levin (2006) and Monacelli (2009) ). Chart 1 shows the impulse responses to an unexpected rise in the policy rate.

BankBazaar

JANUARY 11, 2022

If you don’t have a good insurance policy, now is a good time to get one. Here are a few tips to make sure you get the most out of your policy so that you’re always ahead of the game: Age Matters. Additional Reading: How Good Is A Standard Individual Benefit-Based Coronavirus Health Insurance Policy? For Existing Policy Holders.

PYMNTS

APRIL 24, 2019

The Consumer Financial Protection Bureau (CFPB) has announced changes to policies on Civil Investigative Demands (CIDs), which are investigational subpoenas issued by the CFPB. The Consumer Financial Protection Act of 2010 authorizes the CFPB to issue CIDs when looking into potential violations of the law.

American Banker

JUNE 8, 2023

Federal bank regulators issued proposed guidelines for banks and other mortgage lenders to craft policies around reconsideration of value requests. The move is the latest aimed at rooting out bias in home appraisals.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content