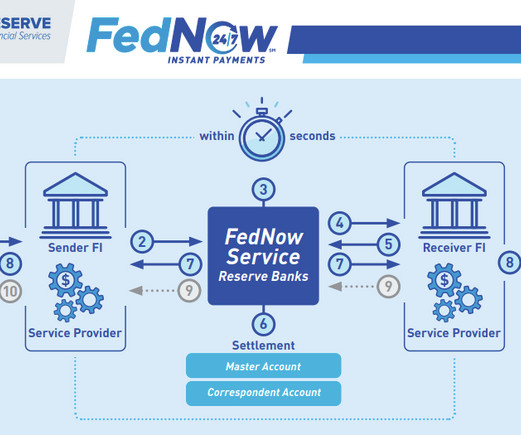

Payments industry to use AI to detect fraud, improve efficiency

Payments Dive

JULY 2, 2024

Research from the investment bank Jefferies suggests generative artificial intelligence could be used in the payments industry to improve fraud detection and make transactions happen faster.

Let's personalize your content