Fed study highlights growth in card, ACH payments

Payments Dive

APRIL 24, 2023

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

Study Related Topics

Study Related Topics

Payments Dive

APRIL 24, 2023

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

Perficient

JANUARY 26, 2021

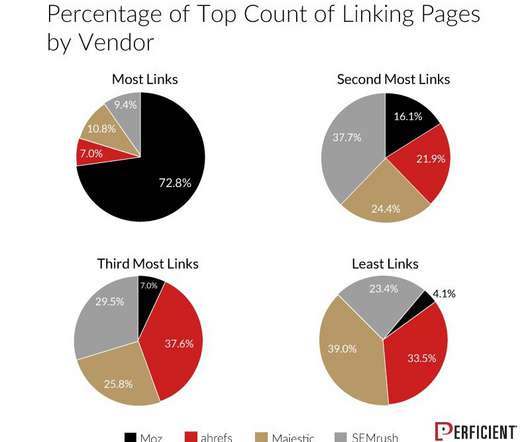

Today’s post will talk about the outcome of a study that addresses this topic. Disclosure : My employer, Perficient, was contracted by Moz to perform this study. In short, Moz influenced the decision to conduct such a study, but the conclusions in this post are 100% our own, with no influence by Moz.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Perficient

SEPTEMBER 18, 2020

We are excited to announce the launch of our recent study, Get Supply Chain Right! This commissioned Forrester Consulting study includes the results from a survey of more than 200 supply chain professionals to gain insights on how intelligent order management and automated supply chains are being utilized throughout US companies.

Payments Dive

NOVEMBER 22, 2022

which researchers said inspires consumers to spend beyond their means — showed larger declines in financial health, a recent academic study determined. Heavy users of buy now-pay later ?

Advertisement

See how theLender, using transformative digital technology, grew their lending volume by orders of magnitude with an innovative approach to mortgage lending. Private lenders are working to keep loan costs down and offer a frictionless and affordable lending experience.

Abrigo

APRIL 28, 2022

How to get the most out of a core deposit study. Takeaway 2 Understanding the key outputs of core deposit studies helps management develop deposit management strategies through pricing. Core Deposit Study Results. Many financial institutions update their study every four to five years. Why such a variance in approaches?

Payments Dive

MAY 30, 2023

New research suggests consumers’ payment method choice can depend on what they’re buying, especially if it’s a guilty-pleasure purchase.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Field of Study: Accounting. Let’s rediscover the power of reconciling the balance sheet, the best way to approach the work, and the pitfalls to avoid when preparing or examining reconciliations. 1 CPE credit will be provided for qualifying participants. Recommended CPE: 1 CPE. Program Cost: $0. Program Knowledge Level: Overview.

Advertiser: ZoomInfo

Studies show the return on investment (ROI) of conversational marketing helps your marketing team drive revenue. Whether it’s a business deal or a personal connection, they are a driving force to solidify a foundation of trust. According to Bold 360, “81 percent of B2B buyers have left a page because they didn’t want to fill out a form.”.

Advertiser: ZoomInfo

Multiple industry studies confirm that regardless of industry, revenue, or company size, poor data quality is an epidemic for marketing teams. As frustrating as contact and account data management is, this is still your database – a massive asset to your organization, even if it is rife with holes and inaccurate information.

Advertiser: Data Robot

Case studies describing how organizations both large and small are leveraging automated machine learning. In this white paper, we cover: The landscape of common AI use cases -- across every line of business and function in a bank. How today’s banks can handle the data science talent shortage. Brought to you by Data Robot.

Advertiser: Data Robot

Case studies describing how organizations both large and small are leveraging automated machine learning. In this white paper, we cover: The landscape of common AI use cases -- across every line of business and function in a bank. How today’s banks can handle the data science talent shortage. Brought to you by Data Robot.

Advertisement

Case Study Franklin Mint) With delinquencies, and the number of consumers looking for payment assistance on the rise, it may be time to consider an efficient cloud-based software to support your team. Learn how MeridianLink® Collect has helped financial institutions like yours streamline collections processes.

Advertiser: ZoomInfo

Using ZoomInfo’s exclusive research, third-party studies, and analyst briefs, this eBook aims to help B2B sales leaders better understand: Different ways prospecting solutions maximize sales productivity and effectiveness. Five essential features to consider when assessing the vendor landscape.

Advertiser: Data Robot

Renowned author and professor Tom Davenport conducted an in-depth study (sponsored by DataRobot) on how organizations have become AI-driven using automated machine learning. While everyone is talking about machine learning and artificial intelligence (AI), how are organizations actually using this technology to derive business value?

Let's personalize your content