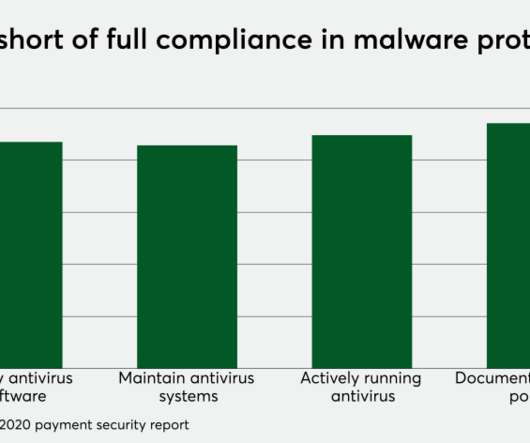

Can payments embrace both innovation and security?

Accenture

AUGUST 10, 2022

The post Can payments embrace both innovation and security? But that excitement is often tempered by concerns that efforts to capture compelling business opportunities may expose the new venture—and the firm—to unnecessary cybersecurity risk. But what if both the business and cyber teams were fully….

Let's personalize your content