Financial Institutions Face Critical Crossroads in 2024

The Financial Brand

NOVEMBER 12, 2023

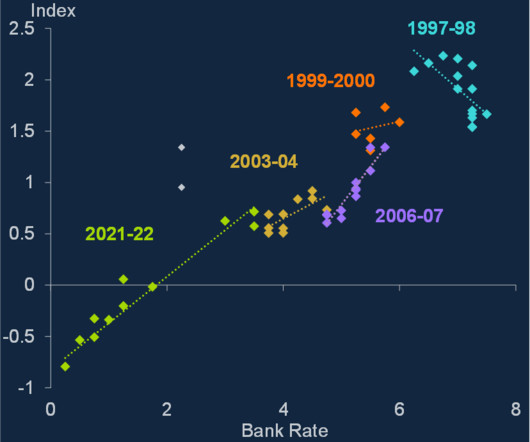

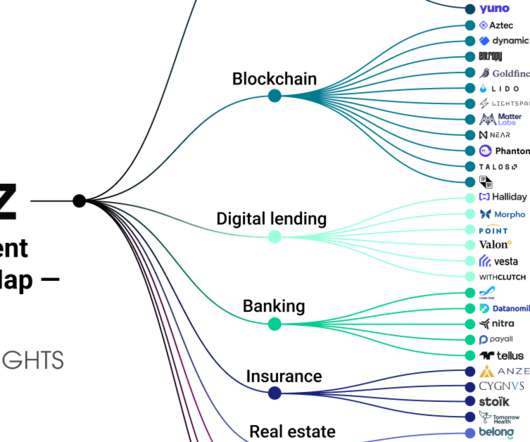

This article Financial Institutions Face Critical Crossroads in 2024 appeared first on The Financial Brand. 2024 will be a pivotal year for a banking industry faced with an uncertain economy – but also with significant opportunities for growth. This article Financial Institutions Face Critical Crossroads in 2024 appeared first on The Financial Brand.

Let's personalize your content