Cross-border payment plays rev up

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

Accenture

FEBRUARY 22, 2022

As you read this, the internet is being reshaped. And it’s already transforming banking. We have not witnessed a topic explode quite like the metaverse. While extended reality (XR) technology has been around for some time, the topic’s momentum has recently accelerated with some analysts now predicting the metaverse to be an $8 trillion opportunity.….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Independent Banker

MAY 31, 2022

Photo by Chris Williams. Community continuation is not about checking a regulatory box; it means putting a name to the people who will be the future of our banks. One of my favorite sayings my dad passed onto me is also a motto I live by: “How far you go in life depends on your being tender with the young, compassionate with the aged, sympathetic with the striving and tolerant of the weak and the strong.

Cisco

NOVEMBER 29, 2022

The functioning of global economies is partially reliant on a secure and protected financial services infrastructure. It is the reason why financial services is one of the most highly regulated and highly fortified industries. Therefore financial institutions require a more resilient operating model, one that has the capability to reduce risk at scale and protect the business amidst unpredictable change.

Advertisement

Discover the key benefits of portfolio loans and learn how to streamline your lending process with our infographic, "5 Things Lenders Need to Know About Portfolio Loans & Their Documentation." Find out how portfolio loans can maximize borrower potential by consolidating multiple properties under a single loan, reducing paperwork, and lowering closing costs.

ATM Marketplace

MAY 6, 2022

It's no surprise that bank branches have had to make adjustments and add new services due to constantly changing circumstances. One such service is remote notarization, a tool that banks can use to notarize documents online.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankUnderground

APRIL 12, 2022

Robert Czech, Pasquale Della Corte, Shiyang Huang and Tianyu Wang. Can investors predict future foreign exchange (FX) rates? Many economists would say that this is an incredibly difficult task, given the weak link between exchange rate fluctuations and the state of an economy – a phenomenon also known as the ‘exchange rate disconnect puzzle’. In a recent paper , we show that some investors in the ‘FX option market’ are indeed able to accurately forecast exchange rate returns, particu

ABA Community Banking

MARCH 3, 2022

On the latest episode of the ABA Banking Journal Podcast, Ohio bank CEO Mike Vynalek discusses his own journey in community bank advocacy and how he's getting emerging leaders at his bank involved in advocacy. The post Podcast: Seeing Results from Community Bank Advocacy appeared first on ABA Banking Journal.

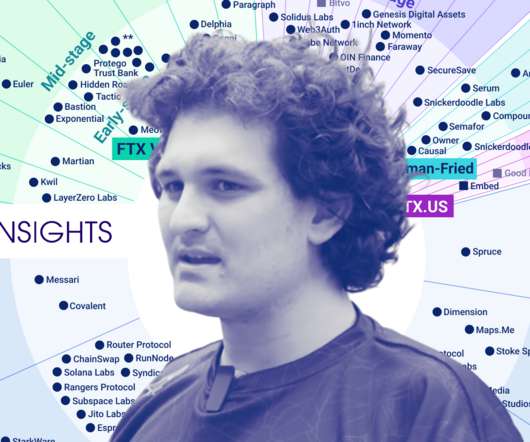

CB Insights

NOVEMBER 17, 2022

Sam Bankman-Fried’s crypto exchange FTX filed for bankruptcy protection on November 11 — the culmination of a steady stream of bad news for the company and a “bank run” that saw roughly $6B in customer withdrawals. A total of 134 affiliated companies were part of the filing, and there could be more than a million creditors involved. download The State of Blockchain q3’22 report.

The Paypers

AUGUST 23, 2022

Japan’s JCB , JP GAMES , and Fujitsu have partnered for a year-long joint project to improve the security of distribution and sales of digital data in the metaverse and gaming world.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant or getting "ghosted" if they fail to meet the evolving needs of Gen Z consumers. In this new webinar, Brian Muse-McKenney of Episode Six and Matt Simester of Payments Consultancy Limited will reveal key considerations banks should factor into their efforts to develop target products for the next generation of bank customers.

Payments Dive

AUGUST 19, 2022

The federal government’s new real-time payments system should be ready for use by the middle of next year, Fed Governor Michelle Bowman said in a speech this week.

The Financial Brand

NOVEMBER 27, 2022

This article Elon Musk’s Twitter Takeover: Lessons for Bank Leaders appeared first on The Financial Brand. Whether or not you approve of how Elon Musk is changing Twitter, his high-stakes actions offer important leadership lessons. This article Elon Musk’s Twitter Takeover: Lessons for Bank Leaders appeared first on The Financial Brand.

Independent Banker

MARCH 31, 2022

Photos by Chris Williams. From credit union overreach to onerous overregulation, the 2022/23 ICBA board of directors has plenty on its to-do list. Executive committee members tell us what advocacy issues they’ll be focused on during their terms, while board members share their words of wisdom for up-and-coming community bankers: themselves. To sum it up, these leaders are all in and all heart for community banking.

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

Cisco

JULY 26, 2022

It’s Blockbuster Night! Say that to any Gen-Xer and it should bring a smile and recollection of days gone by. Netflix took Blockbuster by storm and grew from mail order DVDs to the streaming behemoth they are today. One day, will we reminisce about brick and mortar financial services companies being replaced by digital-first financial services companies like Alipay, Block, Grab, Klarna and Paypal?

Gonzobanker

DECEMBER 19, 2022

OK, show of hands. Who saw 2022 coming and accurately predicted the headlines? All of you with your hands up… … uh huh. Pull ’em down. No, you didn’t. Nobody did. It would have required a few trips to the local dispensary to dream up what bankers have endured this year. A few modest examples of the 2022 roller coaster ride: The Fed rate hikes in 2022 totaled 425 basis points.

TheGuardian

MARCH 29, 2022

Paris, Frankfurt and Dublin are most successful in luring roles from UK, say consultants More than 7,000 finance jobs have moved from London to the EU as a result of Brexit, down 400 from the total anticipated in December, the consultants EY have said While the total is well down on the 12,500 job moves forecast by firms in 2016, when Britain voted to leave the bloc, more could follow, EY said in its latest Brexit tracker.

BankUnderground

AUGUST 18, 2022

Iryna Kaminska and Haroon Mumtaz. Since 2009, when policy rates reached their effective lower bound, quantitative easing (QE) has become an important instrument of central bank monetary policy. It is aimed to work via long-term yields. The literature confirms that QE helped lower long-term yields. But the yields have two components – expectations and term premia – and open questions remain: does QE reduce yields via expected rates or term premia ?

Advertisement

Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers. In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. ThreatMark’s newly released white paper, "The Liability Shift: Understanding Fraud Losses Responsibility and Mitigation," provides an in-depth analysis of this shift, its implications, and stra

Payments Dive

AUGUST 29, 2022

The nation’s biggest bank and bank trade groups stressed the risks of creating a central bank digital currency in comments to the Fed, and largely rejected the idea that a digital dollar would accomplish stated goals.

Payments Dive

JULY 20, 2022

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

Payments Dive

JULY 14, 2022

The Federal Reserve plans to unleash a U.S. real-time payments system next year in the form of FedNow, but it’s an open question as to whether, or how, consumers and businesses will adopt instant payments.

Payments Dive

MARCH 11, 2022

With Russia shut out of U.S. and EU payment infrastructures, the country is pivoting to alternatives such as China's UnionPay card system and other channels that may take its trade and commerce through China.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Payments Dive

OCTOBER 5, 2022

The Block-owned buy now-pay later provider is growing beyond its “pay in 4” plans by adding a financing option for pricier purchases.

Payments Dive

SEPTEMBER 1, 2022

Visa's CFO on Wednesday brushed off any concerns about the threat of new competition from FedNow, or any other real-time payments system.

Independent Banker

JULY 31, 2022

Illustration by miakievy/iStock. The Social Bankers, a collective of community bank marketers, offers inspiration, information and professional development advice to community bankers focused on marketing and social media. We asked them for their need-to-know social tips. By Julie Kendrick. While so many things about banking have changed in recent years, social media continues to grow in its impact on prospects, customers and employees.

Cisco

NOVEMBER 15, 2022

Venmo, just like Google, has become a proper noun AND a verb. Venmo solved a problem of an individual wanting to pay another individual (or even small business) without having to use cash, check or even debit/credit card. Open banking made this possible. Open banking allows third-party financial services companies to access consumer banking, transaction, and other financial data via the secure use of APIs.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Let's personalize your content