Tax ID Fraud is Taxing on Financial Institutions

Abrigo

SEPTEMBER 20, 2023

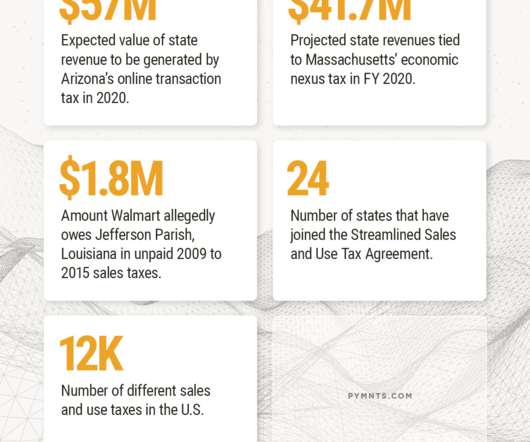

Understanding tax ID fraud FinCrime professionals looking to prevent tax ID fraud, first need to understand the fundamentals of what is happening and their best recourse for prevention. Takeaway 1 Fraudsters file illegitimate tax returns early, hoping people wait to submit their legitimate ones.

Let's personalize your content