Fed dissects consumer use of digital payments

Payments Dive

SEPTEMBER 30, 2024

households have a bank account, just under half use a nonbank payment service, Kansas City Federal Reserve Bank research says. While most U.S.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Kansas City Related Topics

Kansas City Related Topics

Payments Dive

SEPTEMBER 30, 2024

households have a bank account, just under half use a nonbank payment service, Kansas City Federal Reserve Bank research says. While most U.S.

Payments Dive

DECEMBER 6, 2022

The retail giant is serving as a technology vendor to an independent grocer reopening soon in Kansas City, Missouri.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFPB Monitor

NOVEMBER 23, 2021

The Federal Reserve Bank of Kansas City recently issued a research briefing titled “ The Appeal and Proliferation of Buy Now, Pay Later: Consumer and Merchant Perspectives.”. The briefing divides buy now, pay later (BNPL) products into two main types based on how they are offered to consumers.

Payments Dive

AUGUST 15, 2022

The banking-as-a-service company wants to expand its reach as it spins off from the Central Bank of Kansas City.

CFPB Monitor

SEPTEMBER 30, 2022

To read an article published by the Federal Reserve Bank of Kansas City and co-authored by Mr. Alcazar, “ Data Aggregators: The Connective Tissue for Open Banking ,” click here. Alan Kaplinsky, Ballard Spahr Senior Counsel, hosts the conversation. To listen to the episode, click here.

American Banker

JULY 31, 2024

The Kansas City, Missouri-based regional bank said it is making progress on its pending purchase of Heartland Financial USA in Denver. The deal is expected to close during the first quarter of 2025.

SWBC's LenderHub

APRIL 11, 2022

Last week was highlighted by carnage in the long end of the Treasury yield curve as both Federal Reserve Vice-Chairwoman Lael Brainard and Kansas City Federal Reserve Bank President Esther George took to the airwaves to say that the Fed would be reducing its $8+ trillion balance sheet very soon.

American Banker

JUNE 11, 2024

Dickinson Financial in Missouri has no intention of departing from its expansionary mindset as it lays plans for de novo branches and scouts new acquisition opportunities.

PYMNTS

AUGUST 25, 2019

The 2019 Kansas City Federal Reserve’s annual symposium gathered the top monetary policymakers worldwide to kick around ideas to topple the dollar’s power, Bloomberg reported Sunday (Aug. Each year since 1978, the Federal Reserve Bank of Kansas City has sponsored a symposium on an important economic issue facing the U.S.

Bank Innovation

SEPTEMBER 9, 2019

When customers walk into one of Academy Bank’s new branches, a banker will guide them to a screen where they can video chat with a specialist at Academy’s headquarters in Kansas City.

Bank Innovation

FEBRUARY 26, 2018

At Lead Bank, a Kansas City, Mo.-based EXCLUSIVE – Josh Rowland, Chief Executive Officer and Vice Chairman of Lead Bank, will join Jane Barratt, CEO of GoldBean, to discuss banking innovation and bank-startup partnerships. Bank Innovation 2018 will take place March 5-6 in San Francisco.

Bank Innovation

MAY 22, 2019

Kansas City-based nbkc bank is building a conversational banking app with Finastra on the vendor’s growing FusionFabric.cloud open platform.

American Banker

AUGUST 29, 2016

Kansas City Federal Reserve Bank President Esther George is best known nationally as a critic of the Fed’s monetary policy, but in a wide-ranging interview she talks about Dodd-Frank, bank capitalization and the challenges facing community banking, in addition to interest rates.

BankInovation

AUGUST 1, 2022

UMB Bank Chief Information and Product Officer Uma Wilson has focused on bringing together the technology and product development teams since assuming her role at the Kansas City, Mo.-based based bank in 2021.

American Banker

AUGUST 2, 2023

Schmid will assume Esther George's former role on August 21.

American Banker

JANUARY 27, 2023

(..)

Banking Exchange

OCTOBER 23, 2019

The Merger adds 5 Locations Management Feature M&A Feature3 Financial Trends Community Banking.

Payments Source

JUNE 3, 2019

Competition from the public sector in payment services has benefited the public and should not be discounted in the development of a real-time system, said Kansas City Fed chief Esther George.

American Banker

FEBRUARY 29, 2016

First Federal Bank of Kansas City has agreed to a $2.8 million settlement with the Department of Housing and Urban Development to resolve allegations of redlining in African-American neighborhoods.

American Banker

MAY 24, 2024

First Federal Bank of Kansas City finalized a plan to reorganize its corporate structure; Regions Bank in Birmingham, Alabama, was one of 10 to win the "President's 'E' Award for Export Service"; Rhode Island-based Citizens Financial Group named Jim Weiss as Florida market president; and more in this week's banking news roundup.

American Banker

SEPTEMBER 22, 2022

(..)

TheGuardian

APRIL 9, 2023

Bonnie Gooch has been jailed on a $25,000 bond after she was charged with one count of stealing or attempting to steal from a financial institution in the holdup last Wednesday in Pleasant Hill, the Kansas City Star reported. Continue reading.

American Banker

OCTOBER 27, 2023

Umpqua Bank introduces retail banking in Utah, Kansas City CUSO partners with New York gift-card firm, Huntington Bank looks within for new chief DEI officer and more in the weekly banking news roundup.

American Banker

OCTOBER 7, 2020

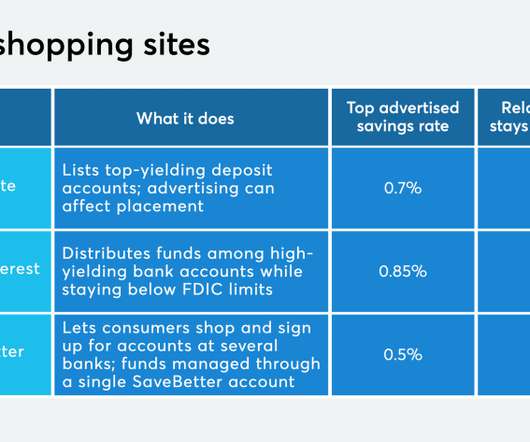

SaveBetter.com from Deposit Solutions lets consumers shop for different savings products through one portal and provides national exposure for participating banks, which include Ponce Bank in New York and Central Bank of Kansas City.

American Banker

APRIL 21, 2021

(..)

South State Correspondent

JANUARY 8, 2015

The Kansas City Fed released an interesting research paper titled The Effect of Risk and Organization Structures on Bank Capital Ratios. The research looks at how risk and a bank’s organizational structure impacts its capital levels. In times of stress, does a bank holding company (BHC) structure help protect a bank or hurt it? '

PYMNTS

DECEMBER 9, 2020

locations recently added for Uber Connect include Atlanta, Boston, Charlotte, Charleston, Cincinnati, Cleveland, Columbus, Connecticut, Detroit, Fort Myers-Naples, Hampton Roads, Honolulu, Indianapolis, Jacksonville, Kansas City, Las Vegas, Milwaukee, Minneapolis-St. Louis, Tucson and Upstate New York.

PYMNTS

SEPTEMBER 9, 2019

19 in five cities: Kansas City, Phoenix, Denver, Indianapolis and Charlotte, North Carolina. The retailer is said to join other merchants such as Nordstrom , Kohl’s, Nike and Macy’s, which have made bigger investments in loyalty efforts. The program was to debut on Feb.

BankInovation

JUNE 29, 2022

The Bank Automation News team is pleased to announce that Michael Beattie, executive vice president and chief technology officer at Kansas City, Mo.-based based Lead Bank, will join the speaker faculty for Bank Automation Summit Fall 2022 to discuss how to develop for the cloud in order to enable technology strategy on Monday, Sept.

American Banker

JUNE 9, 2022

(..)

Independent Banker

JUNE 30, 2022

Location: Kansas City, Mo. Academy Bank in Kansas City, Mo., is a full-service commercial bank with 80 branch locations in Arizona, Colorado, Kansas and Missouri. billion-asset holding company also headquartered in Kansas City. By William Atkinson. Name: Academy Bank. Assets: $2.3

American Banker

APRIL 24, 2020

Betterment has debuted a bank account, in conjunction with partner nbkc bank in Kansas City, Mo., that is targeted at millennials and marketed as a complement to its long-term savings products.

PYMNTS

OCTOBER 13, 2020

The August reopening of one of those theaters – the location in Kansas City -- included some extra flair. million theater-goers had attended movies at AMC venues from the time of the theater reopenings, a decline of about 85 percent compared to a year prior. Celebrating the chain’s 100 th anniversary, AMC charged 15 cents for tickets.

American Banker

MAY 25, 2022

(..)

American Banker

AUGUST 17, 2023

Offices impacted are located in Chicago, Cincinnati and Kansas City, a company representative said Wednesday.

PYMNTS

JULY 22, 2020

a financial services holding company based in Kansas City, Missouri. Brex said the FDIC insurance on uninvested cash reserves up to $250,000 is the result of a partnership with UMB Financial Corp. ,

PYMNTS

MAY 8, 2020

It isn’t alone — Delaware Valley University in Pennsylvania, Kansas City University and Central Michigan University are also considering similarly unchanged rates in order to offer an olive branch to students and families struggling due to the virus and the costly rates of higher education.

American Banker

JANUARY 30, 2023

(..)

PYMNTS

JUNE 25, 2020

The company said in a release that it piloted the expanded grocery pickup program in Kansas City and in the Twin Cities in Minnesota. The move adds fresh and frozen grocery items to its existing pickup and delivery program.

PYMNTS

AUGUST 15, 2019

“Ken brings deep financial services insights and technical expertise to his new role,” said Esther George, president and chief executive officer, Federal Reserve Bank of Kansas City, who is also the sponsor of the Fed’s payments improvement initiative. “He

ABA Community Banking

JANUARY 16, 2020

Speaking to attendees at a mortgage industry event in Kansas City, Missouri, today, Federal Reserve Governor Michelle Bowman expressed optimism about the trajectory of the housing market but raised concerns about the declining number of community banks remaining in the consumer real estate mortgage market.

American Banker

AUGUST 20, 2021

(..)

South State Correspondent

AUGUST 19, 2022

Kansas City Fed President Esther George was more moderate in her rate-hiking expectations near-term, but she did emphasize the need to raise rates until inflation eases back to its 2% target.

PYMNTS

AUGUST 20, 2020

20, 1920 at the corner of 12 th Street and Grand Boulevard in Kansas City, Missouri. The reopening coincides with the 100 th anniversary of the launch of the chain, which opened its first theater on Aug. AMC said it plans to reopen another 300 theaters by Sept. 3, in time for Warner Bros.’

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content