How digital wallets are reshaping the payments landscape

Payments Dive

MAY 13, 2024

Digital wallets have grown in popularity as consumers have become accustomed to the convenience and flexibility of contactless payments.

Payments Dive

MAY 13, 2024

Digital wallets have grown in popularity as consumers have become accustomed to the convenience and flexibility of contactless payments.

South State Correspondent

MAY 15, 2024

Bankers have been taught to diversify their loan portfolio to reduce idiosyncratic (individual borrower) risk and to stabilize earnings. The thinking is that diversification-induced lending leads to banking resiliency. We believe that while lending diversification leads banks to lend more in normal times (especially for banks over $50B in assets) and does benefit the general economy, community banks should be careful in how and where they choose to diversify.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Gonzobanker

MAY 16, 2024

Digital metrics at banks and credit unions are not all trending up and to the right. But there are some bright spots. A new report on digital banking metrics and the impact that digital banking is having on banks reveals some positive developments, but also a host of troubling trends that should give bank executives cause for concern. The fourth edition of the Digital Banking Performance Metrics study from Cornerstone Advisors, commissioned by Alkami, captures digital banking metrics from banks

BankInovation

MAY 15, 2024

AI and generative AI applications continue to dominate conversations within the financial services industry, but implementing generative AI is near impossible if bank data isn’t standardized and accessible. What makes good data?

Advertisement

Discover the key benefits of portfolio loans and learn how to streamline your lending process with our infographic, "5 Things Lenders Need to Know About Portfolio Loans & Their Documentation." Find out how portfolio loans can maximize borrower potential by consolidating multiple properties under a single loan, reducing paperwork, and lowering closing costs.

Payments Dive

MAY 14, 2024

The retailer will add terminals to 3,000 of its Speedway locations and test services like cryptocurrency purchases with ATM solution provider FCTI.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Cisco

MAY 15, 2024

The Digital Operational Resilience Act (DORA) offers financial service institutions the chance to enhance operational resilience and competitive advantage through compliance, with Cisco providing a comprehensive suite of solutions to support FSIs in meeting these new regulatory requirements.

BankInovation

MAY 17, 2024

Small business clients looking to make data-driven business decisions within their operations don’t always know how to tap into their data, but JPMorgan Chase has created a solution to deliver these insights.

Payments Dive

MAY 15, 2024

Concerns about the $35B merger proposal, which has already faced opposition, are likely to surface again at the July public meeting.

ATM Marketplace

MAY 17, 2024

The future of ATMs lies not as machines that just dispense cash, but rather as multifunctional banking kiosks,

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant or getting "ghosted" if they fail to meet the evolving needs of Gen Z consumers. In this new webinar, Brian Muse-McKenney of Episode Six and Matt Simester of Payments Consultancy Limited will reveal key considerations banks should factor into their efforts to develop target products for the next generation of bank customers.

TheGuardian

MAY 12, 2024

Among world’s top 60 banks those in US are biggest fossil fuel financiers, while Barclays leads way in Europe The world’s big banks have handed nearly $7tn (£5.6tn) in funding to the fossil fuel industry since the Paris agreement to limit carbon emissions, according to research. In 2016, after talks in Paris, 196 countries signed an agreement to limit global heating as a result of carbon emissions to at most 2C above preindustrial levels, with an ideal limit of 1.5C to prevent the worst impacts

Commercial Lending USA

MAY 17, 2024

One of the largest companies that offers business loans is Commercial Lending USA. You can get money from them to help your business grow and stay ahead of the competition.

Payments Dive

MAY 15, 2024

The payments processing company plans to incorporate Revel’s point-of-sale capabilities into its SkyTab POS system, Shift4 CEO Jared Isaacson said.

ATM Marketplace

MAY 14, 2024

Cardless ATMs are paving the way for a more convenient banking experience by enabling Google and Apple Pay transactions.

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

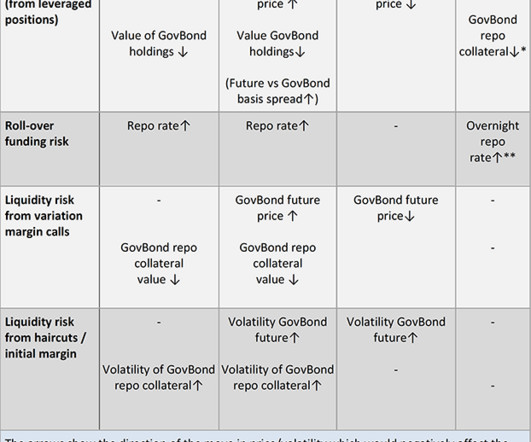

BankUnderground

MAY 16, 2024

Adam Brinley Codd, Daniel Krause, Pierre Ortlieb and Alex Briers We both drive cars, but the US drives on the right while the UK drives on the left. We both walk, but we do so on sidewalks in the US and pavements in the UK. We both have asset managers, who want to take leveraged positions in interest rates. US asset managers had around US$650 billion of long treasury futures in June 2023.

TheGuardian

MAY 13, 2024

Younger homebuyers are turning to ultra-long loans, prompting fears over the risk to their finances and the wider economy For a long time the traditional length of a UK mortgage has been 25 years, but runaway house prices and, more recently, dramatically higher borrowing costs are prompting more and more people to “go long” on their home loans. On Monday, the former pensions minister Steve Webb revealed that younger homebuyers were increasingly being forced to gamble with their retirement prospe

Payments Dive

MAY 14, 2024

The Federal Reserve Board said it has received some 2,500 comment letters regarding its Regulation II proposal to cut the fees that merchants are charged when they accept debit cards.

Jack Henry

MAY 16, 2024

Soon, we will be back to “normal,” or at least something that resembles it. Promising vaccines are on the horizon. In some states, businesses are reopening. Holiday shopping is even underway. At the same time, millions of US-based businesses are preparing for 2021 and what it may bring. Through the sharp second quarter decline, many industry sectors saw gross revenues drop by more than 40%.

Advertisement

Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers. In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. ThreatMark’s newly released white paper, "The Liability Shift: Understanding Fraud Losses Responsibility and Mitigation," provides an in-depth analysis of this shift, its implications, and stra

William Mills

MAY 14, 2024

In a constantly evolving world and financial landscape, understanding today’s trends will guide future decision making and allow banks and credit unions to prepare their financial institution for the future.

American Banker

MAY 15, 2024

As part of a sweeping digital enhancement of its consumer payment cards, Visa will enable banks to issue an account as a credit, debit, virtual or Pay in 4 installment loan, based on the user's preference at the time of purchase.

Payments Dive

MAY 13, 2024

The 5th Circuit Court of Appeals blocked the Consumer Financial Protection Bureau’s $8 late fee cap on Friday, but the federal agency said it will continue to “defend” the rule.

Jack Henry

MAY 16, 2024

FASB’s Accounting Standards Update (ASU) No. 2016-13 (more commonly referred to as CECL) was released earlier this year in June. At first look, the implementation dates for CECL are so far out that this project may not rank very high on a management team’s to-do list. Public business entities (PBEs) that are SEC registered have a regulatory reporting effective date March 31, 2020.

Advertisement

Discover First Mid Bank's Expansion Success with Our Case Study! Discover how First Mid Bank & Trust fast-tracked market expansion through advanced automation and compliance solutions. This case study reveals their journey from facing challenges in Texas' complex legal landscape to achieving rapid market entry with GoDocs' innovative commercial closing platform.

Commercial Lending USA

MAY 14, 2024

Businesses can get low-interest commercial loans to help them with things like growing, buying tools, or keeping track of their inventory.

American Banker

MAY 14, 2024

Part of the Consumer Financial Protection Bureau's mandate is to educate consumers by providing reliable information. With its credit card late fee "report" and the associated rulemaking, it has failed to live up to that responsibility.

Payments Dive

MAY 16, 2024

Fidelity National Information Services is targeting revenue growth of as much as 4.5% this year as it scans the landscape for “tuck-in” acquisitions following the spin-off of Worldpay.

The Paypers

MAY 14, 2024

Global provider of financial software applications Finastra has announced the completion of testing and certification for ISO 20022.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content