South Carolina embraces new EWA law

Payments Dive

MAY 23, 2024

This week, South Carolina became the fifth state to enact a law regulating earned wage access providers, but it doesn’t subject them to lending laws.

Payments Dive

MAY 23, 2024

This week, South Carolina became the fifth state to enact a law regulating earned wage access providers, but it doesn’t subject them to lending laws.

Gonzobanker

MAY 23, 2024

It’s “leave your emotions at the door” time when making a core system decision. Esteemed Gonzo readers, let’s get right to one of the core challenges in banking. Every financial institution needs to get real, tangible returns on every technology investment it makes, and core systems are a critical piece in increasing or hurting these returns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 23, 2024

“All parties in the payments ecosystem would benefit greatly from state laws that provide clarity and consistency between jurisdictions,” write two legal professionals.

BankInovation

MAY 23, 2024

TD Bank is exploring the use of generative AI within its institution through pilot programs. “Understanding how generative AI can be used to augment the work of our colleagues has always been our focus,” Imran Khan, head of TD Invent, the bank’s innovation arm, told Bank Automation News.

Advertisement

Discover the key benefits of portfolio loans and learn how to streamline your lending process with our infographic, "5 Things Lenders Need to Know About Portfolio Loans & Their Documentation." Find out how portfolio loans can maximize borrower potential by consolidating multiple properties under a single loan, reducing paperwork, and lowering closing costs.

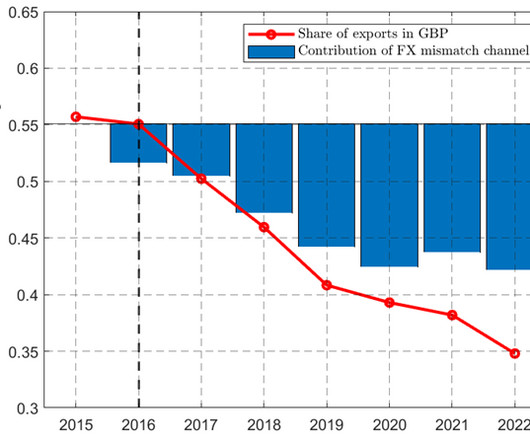

BankUnderground

MAY 23, 2024

Marco Garofalo, Giovanni Rosso and Roger Vicquery Most international trade is denominated in dominant currencies such as the US dollar. What explains the adoption of dominant currency pricing and what are its macroeconomic implications? In a recent paper , we explore a rare instance of transition in aggregate export invoicing patterns. In the aftermath of the depreciation that followed the Brexit referendum in 2016, UK exporters progressively shifted to invoicing most of their exports in dollars

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

MAY 23, 2024

The bank took a big hit on an office property in Washington, D.C., during the first quarter. This month, it filed a shelf registration statement for an offering of up to $150 million that could be used to bolster capital or refinance debt.

BankInovation

MAY 23, 2024

Nvidia’s data center revenue skyrocketed during its fiscal first quarter 2025 as companies look to the chip-making giant for AI infrastructure. Data center revenue reached $22.6 billion, up 427% year over year, according to the company’s earnings report for the quarter ended April 28.

American Banker

MAY 23, 2024

New technology decoupling payment cards from the funding source of the transaction would stimulate competition between card issuers and networks — and raise prospects for Capital One's proposed $35 billion acquisition of Discover Financial Services.

The Paypers

MAY 23, 2024

Trading and investment platform eToro has partnered with Arabesque AI to launch a new Sharia-compliant portfolio for users in the Middle East.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant or getting "ghosted" if they fail to meet the evolving needs of Gen Z consumers. In this new webinar, Brian Muse-McKenney of Episode Six and Matt Simester of Payments Consultancy Limited will reveal key considerations banks should factor into their efforts to develop target products for the next generation of bank customers.

American Banker

MAY 23, 2024

In this week's edition of the American Banker news quiz, see how well you know current items about the Federal Deposit Insurance Corporation, mergers and acquisitions, the Consumer Financial Protection Bureau and more.

BankInovation

MAY 23, 2024

Ally Financial is continuing to invest in technology and generative AI to offer improved car sale recommendations and inventory options for dealers.

American Banker

MAY 23, 2024

The SEC's pending requirement that securities trades settle within one day shouldn't be a problem for any modern financial firm. What we should be aiming for is real-time settlement.

The Paypers

MAY 23, 2024

Google Pay has announced the launch of three new features that aim to provide customers with an optimised and secure checkout experience.

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

ABA Community Banking

MAY 23, 2024

The ABA Foundation announced that DeKalb, Mississippi-based Commercial Bank became the 1,000th bank to participate in its free financial education programs. The post ABA Foundation reaches financial education milestone with 1,000 participating banks appeared first on ABA Banking Journal.

Commercial Lending USA

MAY 23, 2024

Commercial Lending USA put together this detailed guide to help people who want to borrow money learn more about construction loan interest rates.

American Banker

MAY 23, 2024

Executives at the Toronto-based bank said last year that they planned to add 150 branches in the United States. But when pressed on Thursday, they could not say how much they'll scale back their ambitions due to investigations over TD's anti-money laundering practices.

The Paypers

MAY 23, 2024

Digital financial solutions provider UnaFinancial has partnered with JSCB Microcreditbank to deliver instalment loans to micro-entrepreneurs with 3, 6, and 9-month repayment terms.

Advertisement

Discover First Mid Bank's Expansion Success with Our Case Study! Discover how First Mid Bank & Trust fast-tracked market expansion through advanced automation and compliance solutions. This case study reveals their journey from facing challenges in Texas' complex legal landscape to achieving rapid market entry with GoDocs' innovative commercial closing platform.

American Banker

MAY 23, 2024

Numisma Bank, a de novo bank backed by former Federal Reserve Vice Chair Randal Quarles, is the first bank without deposit insurance to be granted conditional approval under the Fed's new master account application framework.

The Paypers

MAY 23, 2024

Finastra , a provider of financial software applications and marketplaces, announced its selection by LGT to implement instant payment services in Austria and Liechtenstein.

American Banker

MAY 23, 2024

The outgoing CEO, now executive chairman of the Wall Street firm, told a conference at the Federal Reserve Bank of New York this week that cultural values are a critical element in any prospective merger or acquisition deal.

The Paypers

MAY 23, 2024

US-based Banking-as-a-Service platform Synctera has announced the launch of the Bring Your Own Bank (BYOB) model, intending to improve the customer experience further.

Advertisement

Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers. In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. ThreatMark’s newly released white paper, "The Liability Shift: Understanding Fraud Losses Responsibility and Mitigation," provides an in-depth analysis of this shift, its implications, and stra

American Banker

MAY 23, 2024

An agreement with the Office of the Comptroller of the Currency will require Dallas-based Comerica Bank to institute a list of corrective actions regarding a range of compliance issues, including wealth management, third-party risk and financial accounting.

The Paypers

MAY 23, 2024

Thailand-based KASIKORNBANK (KBank) has expanded its mobile payment service by integrating its KBank Visa Credit Card with Google Pay in the Google Wallet app.

American Banker

MAY 23, 2024

The bank plans to use artificial intelligence to make recommendations based not just on transaction analysis, but on shopper intent and behavioral data.

The Paypers

MAY 23, 2024

UK-based payments provider DNA Payments has partnered with SUNMI to solidify both companies’ presence in the UK and expand their solution offering.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content