Announcing Perficient’s Forrester Consulting-Commissioned Study: Get Supply Chain Right!

Perficient

SEPTEMBER 18, 2020

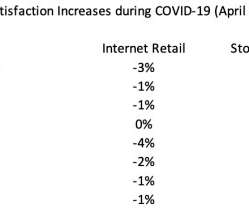

We are excited to announce the launch of our recent study, Get Supply Chain Right! This commissioned Forrester Consulting study includes the results from a survey of more than 200 supply chain professionals to gain insights on how intelligent order management and automated supply chains are being utilized throughout US companies.

Let's personalize your content