How Unify Turned Month-End Mayhem Into a Growth Party With Automation!

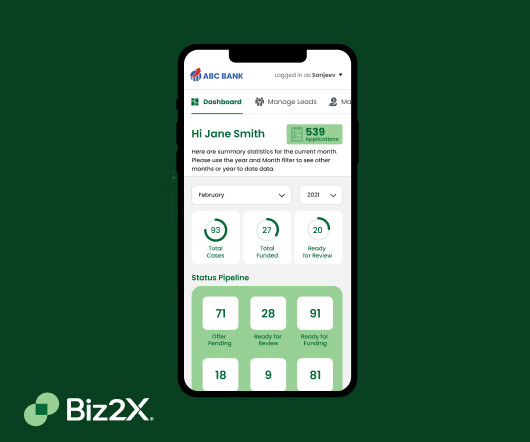

By ditching paper and manual checklists, UNIFY embraced ART’s cloud-based solution for seamless automation. The robust dashboards, exception reports, and completion date reports allowed the team to easily track progress and resolve bottlenecks. ART’s flexible access for auditors ensured tight deadlines were met effortlessly. With competitive pricing and a rapid setup, ART cut costs and minimized disruptions, enabling UNIFY’s team to concentrate on high-impact tasks.

Let's personalize your content