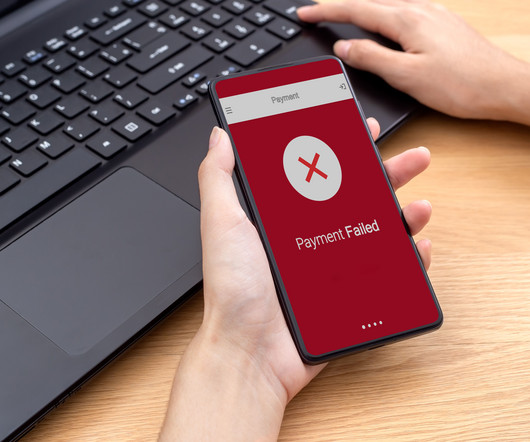

A third of banks ban employees from using gen AI. Here's why.

American Banker

MARCH 18, 2024

False information, job losses, diminishing skills and human interaction, among other concerns, have bankers worried about deploying both generative artificial intelligence, like ChatGPT, and more long-accepted forms of AI like machine learning, according to a new survey of American Banker readers.

Let's personalize your content