Avoiding AML compliance penalties – Tips from a former regulator

Abrigo

SEPTEMBER 20, 2023

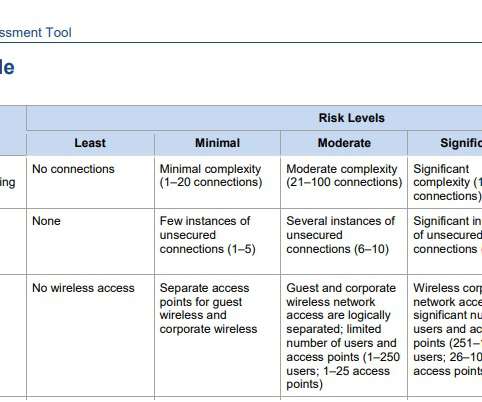

Regulators take risk seriously, and knowing just how much risk your institution can take while remaining compliant is essential. FinCEN said this was done with little to no risk management program. Make your voice heard and document your disagreement. Significant risk doesn't always mean a big reward for financial institutions.

Let's personalize your content