Amazon Uses Its Machine Learning Tools for Lending

Bank Innovation

JUNE 8, 2017

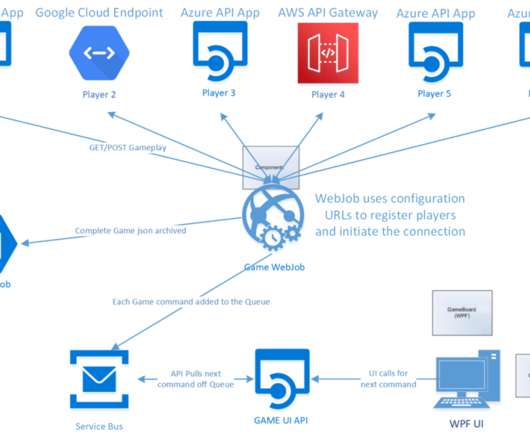

When talking about machine learning algorithms, Amazon definitely comes to mind. Turns out, Amazon’s lesser known operation – small business lending – is also powered by machine learning, Bank Innovation has learned. […].

Let's personalize your content