Why banking technology makes sense – recession or not

Abrigo

MARCH 2, 2023

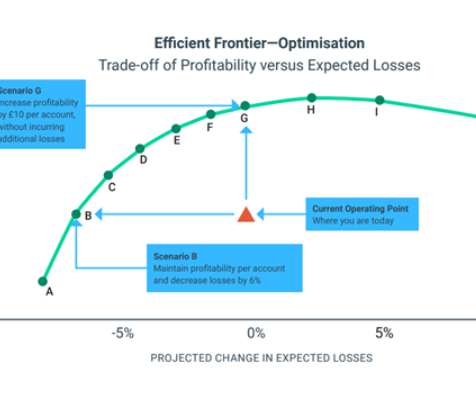

Banking technology decisions now affect future growth With the possibility of a recession, community financial institutions may consider a delay or cut in technology spending. Takeaway 2 According to Forrester data, firms pursuing technology-driven innovation grow three to four times faster than industry averages.

Let's personalize your content