Markup matters: monetary policy works through aspirations

BankUnderground

MARCH 28, 2024

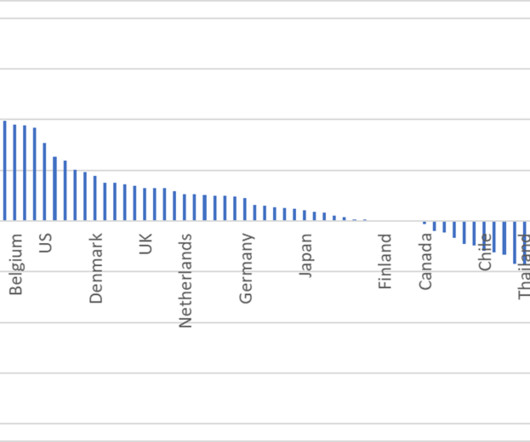

In our recently published Staff Working Paper , we ask how monetary policy should be conducted amid, what has been referred to as, a ‘battle of the markups’. We find that countercyclicality in aspired price markups (‘sellers’ inflation’) calls for more dovish monetary policy. This could give rise to unstable wage-price dynamics.

Let's personalize your content