CBD And Cannabis Industries Attract Payments And Compliance Players

PYMNTS

JULY 1, 2019

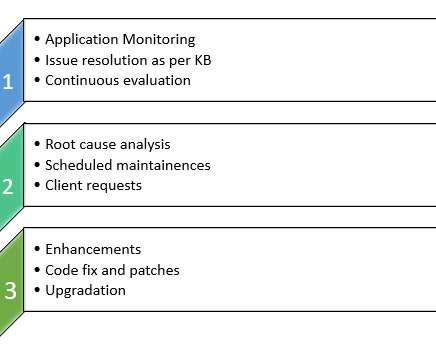

When it comes to the new and emerging legal cannabis industry – along with the closely related trade in CBD products – payments and compliance issues, as one can imagine, have tremendous importance, and companies are striving to get into the game via those angles. The market could reach $16 billion by the year 2025, per a Cowen & Co.

Let's personalize your content