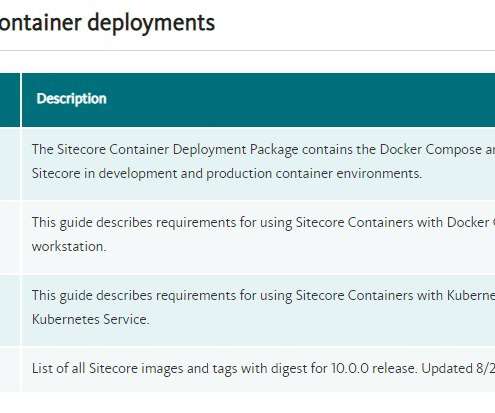

Community Bank Performance – 2Q Lessons

South State Correspondent

SEPTEMBER 11, 2023

In this article, we analyze the underlying data for community banks and focus on the Chairman’s view of the future of bank performance. Community banks were challenged with increasing deposit costs and a lower increase in loan yield than the industry average, leading to a decline in NIM.

Let's personalize your content