How to Use RFM Customer Segmentation Analysis in Banking

In banking, there is often a discussion about “who are our best customers?” Some banks rank customers against current profitability, others against lifetime profitability, and some use a technique called “RFM,” which stands for “Recency,” “Frequency,” and “Monetary.” This article explores the methodology and shows you what this analysis means for a typical bank.

How RFM Customer Segmentation Analysis Works

Recency, Frequency, and Monetary value are each aspect of a customer trait that denotes some value in banking. RFM provides insight into expected conversion rates, potential defections, and lifetime value. Many advanced bank marketers use RFM as a basis for marketing campaigns, while product managers use RFM to drive engagement, and bank executives use RFM to determine the overall health and quality of their customer base.

A bank’s main objective isn’t to make loans or gather deposits but to gather and grow a portfolio of profitable and engaged customers. If true, RFM is one methodology to help bankers steer their banks to quality growth.

RFM Customer Segmentation breaks down into the following components:

Recency: We wrote in depth about it HERE. Recency is based on the data that shows a bank customer is more likely to do business with your bank in other products right after a major transaction. A bank has approximately seven months after opening an account or purchasing a material product such as wealth management, a mortgage, or a line of credit to build deposit balances and increase profitability. After the seventh month, conversion rates sharply declined. Strike early and often to keep the customer building their relationship with your bank.

Frequency: The more engaged a customer is with your bank, the more likely they are to do business with you. As every banker knows, capturing the transaction account of every household and business should be the number one goal of any bank.

Monetary: As we wrote about HERE when we detailed our favorite 15 deposit marketing campaigns, the more profitable a customer is at your bank, the higher the likelihood they are also profitable for other banks. As such, banks should be looking for a higher share of wallet from their most profitable customers while they look for other ways to increase the profitability of their second and third-quartile customers.

What Questions Does RFM Customer Segmentation Answer

RFM analysis helps bank marketers and management find answers to the following questions:

- Who are our best customers?

- Which customer segments drive our churn rate?

- Which bank customer has the potential to be in the top quartile of lifetime profitability?

- Which of your customer segments should we market to help stem defections?

- Which customers should receive deposit rate increases to keep them from defecting?

- What rate should we pay a deposit customer at risk of defecting?

- Which of your customers are most likely to respond to an engagement or promotional campaign?

How to Implement RFM Customer Segmentation

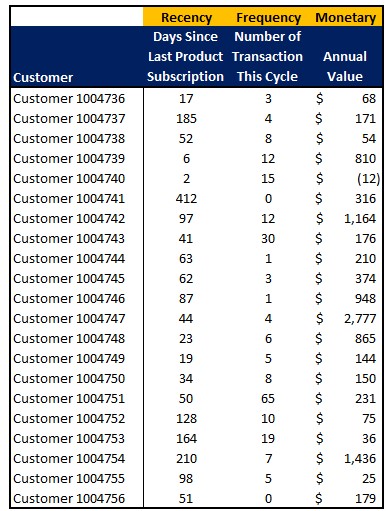

Let’s demonstrate how RFM works by considering a sample dataset of customer transactions:

After bankers have a customer dataset of RFM values, they next score them by ranking each RFM category separately.

Here, we will use a rank from 1 to 10 to break customers into decile segments.

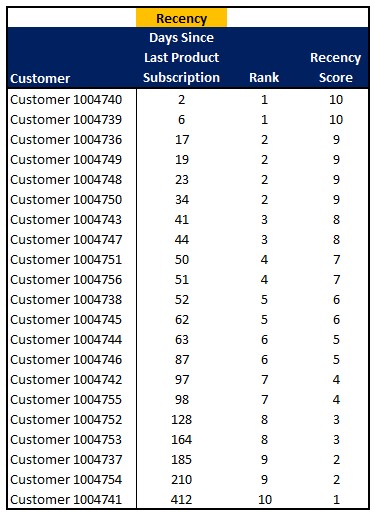

Let’s begin with ranking customers on recency first, as shown in the table below:

Now, the customers that have most recently opened an account are at the top with the highest Recency Score. As a starting point, we can take all customers with a score of five or higher and launch a marketing campaign to see if they are interested in another bank product. However, we can do better.

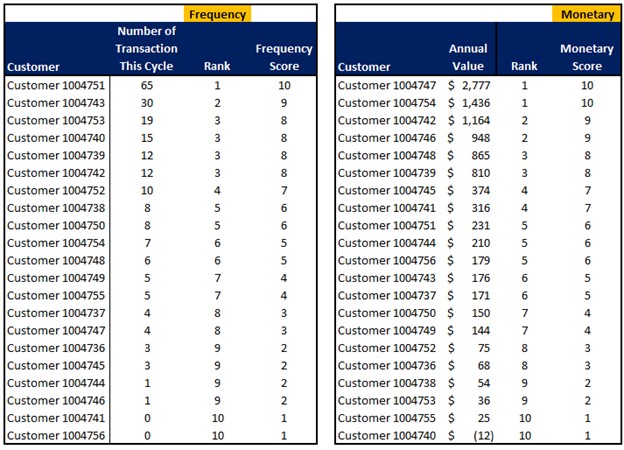

We do the same thing for the Frequency and Monetary values (below).

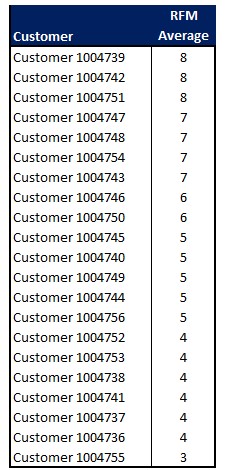

Finally, we can rank these customers by combining their individual R, F, and M rankings to arrive at an aggregated RFM score. We do this by weighing the highest monetary value, followed by the Frequency of transactions, and then by the recency.

Advanced banks can get as granular as needed here, and weighting can be refined depending on the data. Certain products, customer segments, and channels may have different weightings than the ones we used above. Banks can have an infinite number of rankings and can weigh accordingly using machine learning, thereby fitting the model to the data. We wanted to keep this analysis simple and available to any bank with an intern and Excel.

We can expand this analysis for any combination of products, channels, customer types, and numbers.

Visualizing Segments

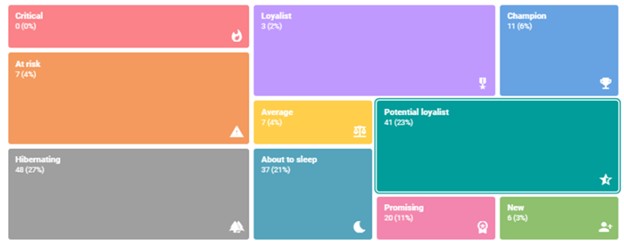

Once customers are scored and ranked, you can categorize them into various segments and visualize them, similar to the tree map below.

Analyzing RFM Segmentation

Here is a breakdown of what some of the more important segment means:

- Champions are the bank’s top customers. They have frequent transactions and are profitable. Banks must continue to acknowledge and target resources to these customers to keep them happy and engaged with the bank. These are excellent customers to invite to focus groups and to test new products with.

- Potential Loyalists are bank customers with average transaction levels and above-average profitability. These are prime candidates for loyalty programs and cross-selling.

- New customers are your customers who have just come into the bank, have frequent transactions, and are on track to be profitable. These customers, because of their recency scores, need to get going with the best foot forward. This is a prime segment for banks to be thoughtful about how to show value and build a relationship. This segment is excellent to engage with through in-person events, webinars, and education.

- At-risk customers are bank customers who are profitable and have an average level of engagement but have not recently materially expanded their relationship by opening a new product. This segment is excellent for personalized outreach, invitations, and financial advisory to see where else the bank can add value.

- Can’t Lose Them is the customer segment that used to have high engagement and was profitable but has slowed down. Lower trending frequency scores indicate they might be heading for defection. Bankers can send this segment surveys to understand their position better while also using special promotions to ignite re-engagement.

- Hibernating customers are those who have been with the bank for a while, do not conduct frequent transactions, and are not profitable. Some of these customers just need to be nudged into a re-engagement campaign and reminded that the bank is still around to support them. Still, others must be introduced to other financial institutions that can better serve their needs, as they may be costing your bank money.

Other categories have varying degrees of recency, frequency, and profitability and could all use some type of marketing to grow their relationship. Knowing the score in each RFM category helps bank marketers determine the type of campaign.

Putting This into Action

RFM customer segmentation is a data-driven customer classification technique more robust than categorizing by profitability alone. The methodology allows bank marketers and executives to segment customers using a proxy for propensity to convert. In this manner, bankers can have a homogenous data set to take tactical action to achieve strategic goals.

In future articles, we will show you tested campaigns to achieve profitability and improve the performance of upper and lower-scoring customers. We will delve into utilizing something similar to this methodology using machine learning. Machine learning and AI move this analysis from being a static snapshot in time to improve the accuracy of predictions.