Open Banking Expands Into SMB Lending, Smaller Banks

PYMNTS

MARCH 12, 2020

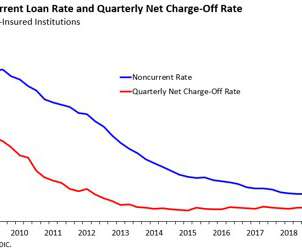

But the latest initiatives reveal a growing interest in transforming internal processes, particularly among smaller banks looking to upgrade their core infrastructure and elevate small business lending operations. The regional bank also noted growing interest among smaller FIs to embrace the bank-FinTech collaboration trend.

Let's personalize your content