6 Reasons Financial Institutions Are Embracing Risk and Regulation Tactics

Perficient

DECEMBER 18, 2023

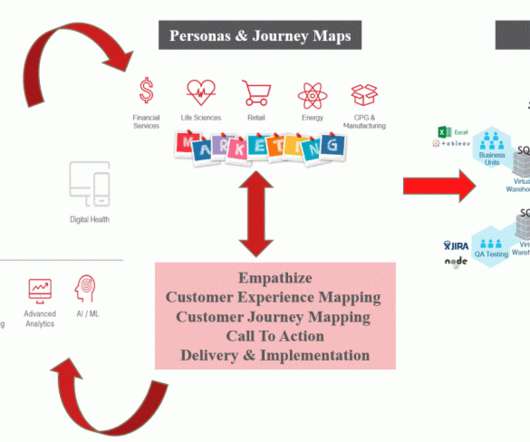

By adopting a proactive stance and leveraging technological advancements, financial entities can navigate the regulatory landscape with greater resilience and efficacy. Legal Obligations and Regulatory Frameworks It is well-known that financial institutions operate within a complex web of laws and regulations.

Let's personalize your content