The Customer Experience: 14 Ways To Better Understand Your Bank Customer

South State Correspondent

AUGUST 15, 2022

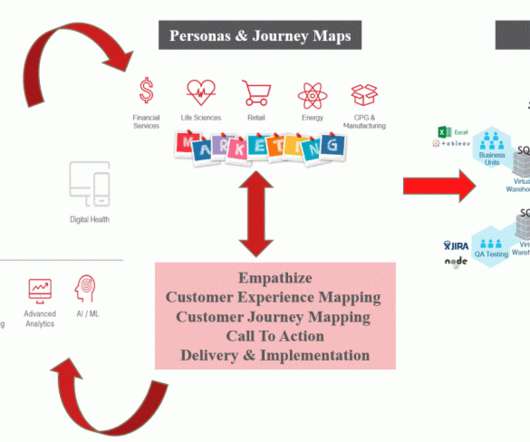

The reality is that banks don’t think from the customer’s perspective enough. The customer experience is horrible for many bank processes. Not understanding your customer can lead to a brand and products misaligned with the customer’s needs resulting in an erosion of a bank’s competitive position.

Let's personalize your content