Finastra launches embedded consumer lending solution

Bobsguide

JULY 7, 2022

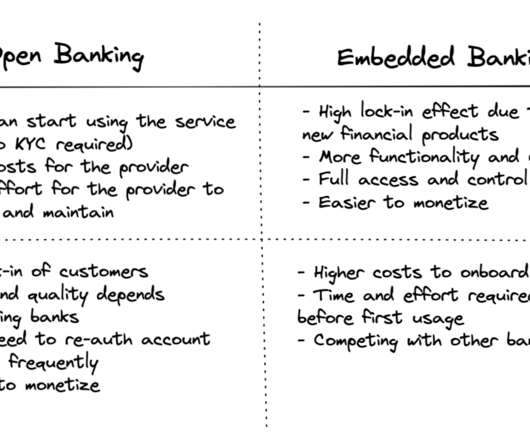

Financial institutions and retail brands gain a new embedded finance platform to help consumers access regulated loans at point-of-sale, powered by Banking as a Service. Financial institutions, distributors and merchants will benefit from a platform that makes it easy for their customers to access lending options.

Let's personalize your content