COVID-19’s impact on banking and capital markets

Accenture

SEPTEMBER 23, 2020

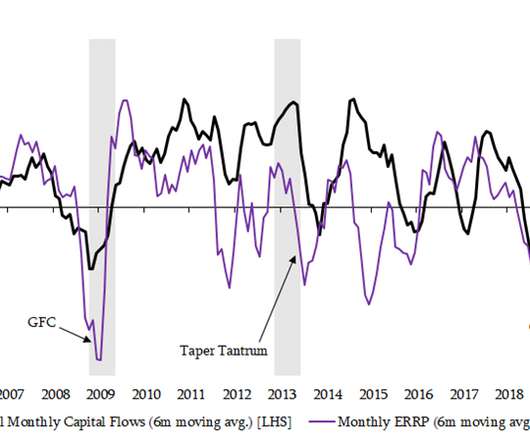

The COVID-19 pandemic has had a significant impact on the banking and capital markets (B&CM) industry as liquidity, rates and fees continue to be stressed and regulatory and business-driven demands evolve rapidly. The post COVID-19’s impact on banking and capital markets appeared first on Accenture Banking Blog.

Let's personalize your content