FICO’s Take On Debit Security

PYMNTS

JANUARY 30, 2020

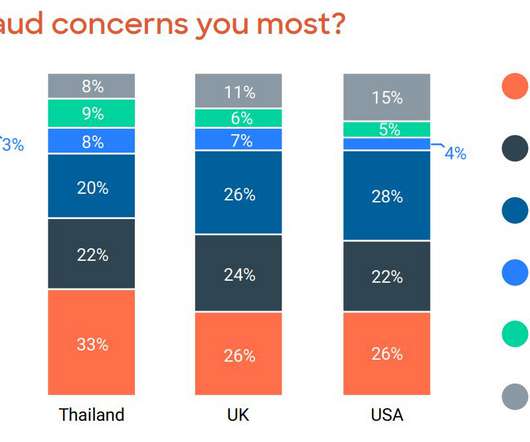

Widely publicized data breaches and hacks have made today’s consumers especially concerned about fraud. Cautious shoppers may find comfort in debit, with fraud losses associated with the payment method declining over the past several years. Card fraud is an ever-present threat. Around The Next-Gen Debit World.

Let's personalize your content