2022 Predictions: Fraud and fintech innovations

BankInovation

JANUARY 3, 2022

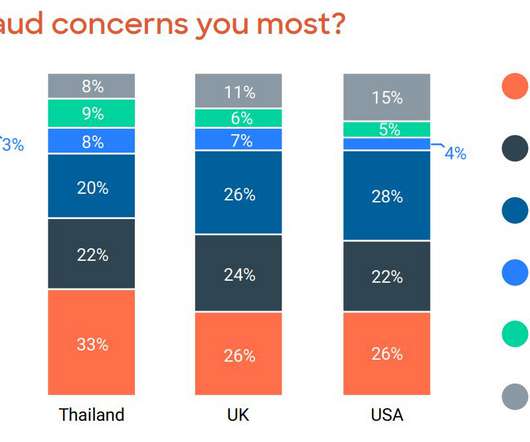

In 2022, banks must counter the continued growth of fraud, which saw increased frequency in the wake of the COVID-19 pandemic, while also acknowledging competitor fintechs as equal players in the financial services space.

Let's personalize your content