Small business lending insights Vol. 1

Abrigo

APRIL 25, 2024

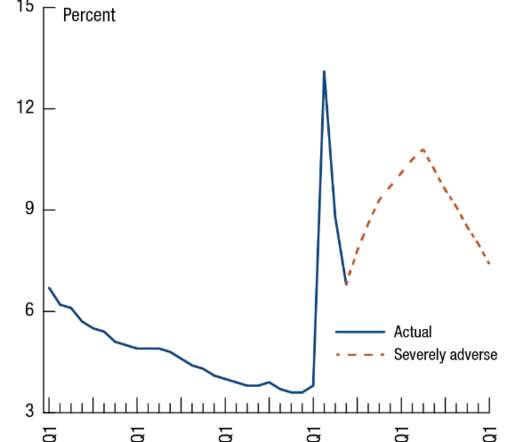

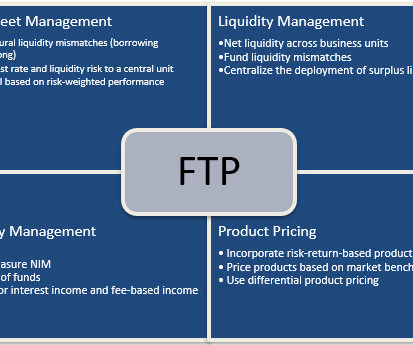

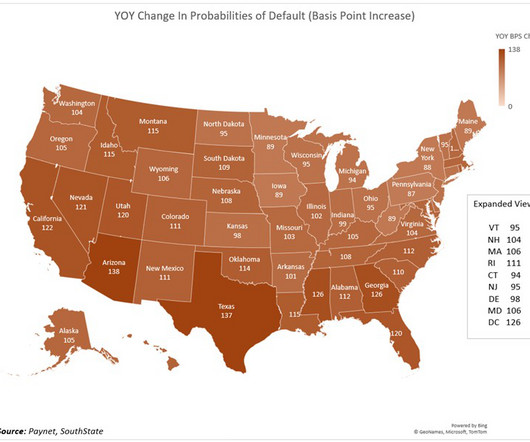

Recent data and trends of the small business lending market SMB Lending Insights is a snapshot of current financial trends and metrics that impact small and medium-sized business (SMB) lending and financial institutions. You might also like this guide for smarter, faster small business lending.

Let's personalize your content