Spotlight on lending: Preparing for Q3 bank reports

Abrigo

OCTOBER 27, 2014

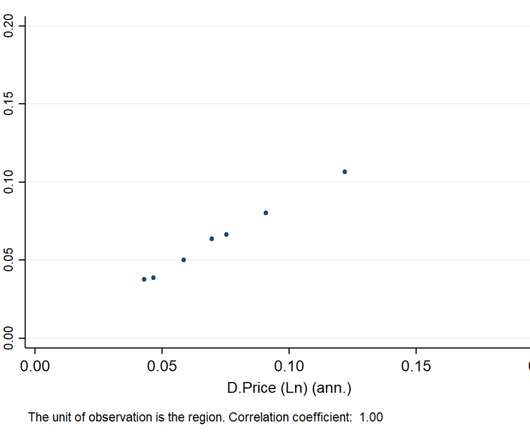

As American Banker reported last week, nearly a dozen regional banks saw scattered growth in their loan portfolios as part of the Q3 filings. bank and credit union, on total loan growth quarter over quarter paint a picture of the state of bank lending leading up to the third quarter. Source: Sageworks Bank Information. As the U.S.

Let's personalize your content