How Banks Can Turn Compliance Burden Into A Data Opportunity

PYMNTS

MARCH 27, 2019

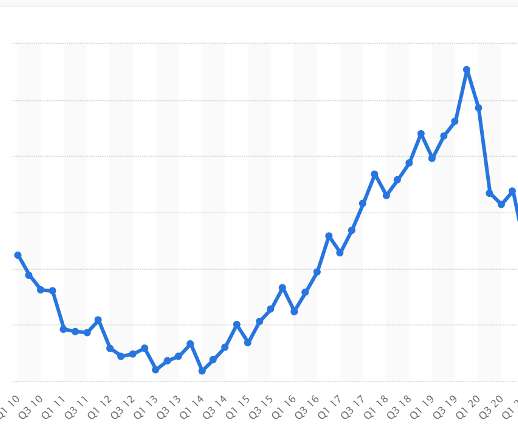

While regulators had transparency and financial security in mind when introducing more stringent requirements for banks following the global financial crisis, financial institutions faced a sudden surge in the burden compliance. The Key To Compliance Is Data.

Let's personalize your content