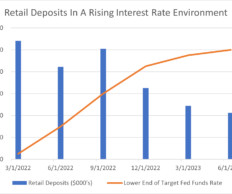

Retail Deposits: Analyzing Deposit Stickiness in the Current Interest Rate Environment

Perficient

NOVEMBER 17, 2023

In our previous article, “ Transaction Accounts: Analyzing Deposit Stickiness in the Current Interest Rate Environment ,” Perficient’s Financial Services Risk Management and Regulatory Capabilities Center of Excellence (CoE) explored the sharp decline in transaction account balances over an 18-month period.

Let's personalize your content