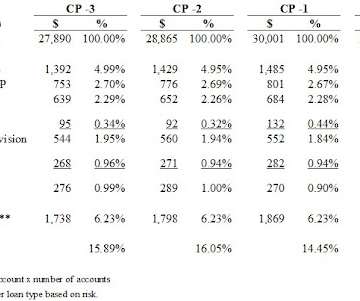

Loan Performance Analysis – Hedged vs. Unhedged Loans

South State Correspondent

SEPTEMBER 4, 2023

We conclude that loan-level hedging offers community banks a strong competitive advantage in the current interest rate and competitive commercial loan and deposit environment. This loan performance is a significant driver of profitability for this group of banks. This hedge fee is a one-time upfront source of income.

Let's personalize your content