Today’s Cyber Risk Management

Cisco

JUNE 7, 2022

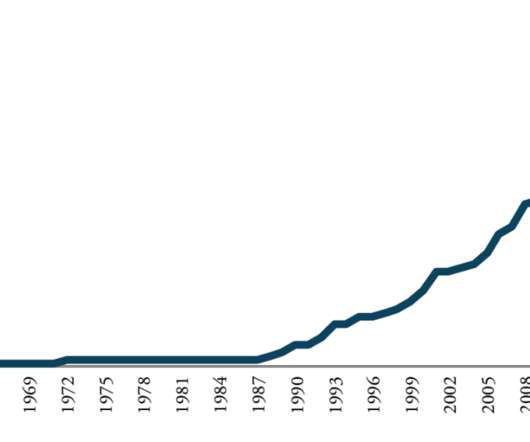

The past 20 years have visibly demonstrated the impact large scale events have on market, credit, and operational risks in financial services. In between these events, a different crisis began in the US sub-prime lending market. Cyber risk is the largest and fastest growing operational risk within financial services.

Let's personalize your content