Here is our Digital Banking Playbook

South State Correspondent

JUNE 14, 2024

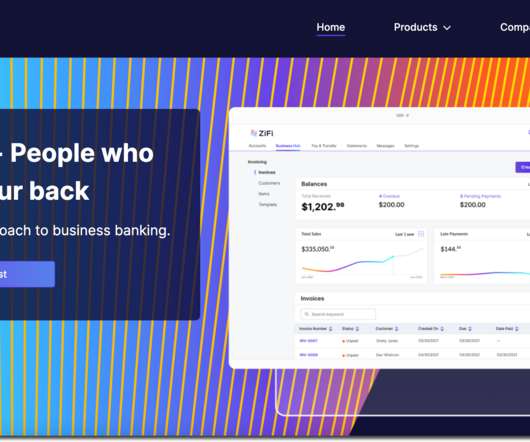

Bankers don’t know what they don’t know, and few bankers outside of national and regional banks have experience with platform selection when it comes to digital banking platforms. Because banks usually must bring together different platforms, the customer experience suffers, and costs are increased for managing multiple platforms.

Let's personalize your content