Strategies for fighting remote authentication fraud

Independent Banker

NOVEMBER 30, 2021

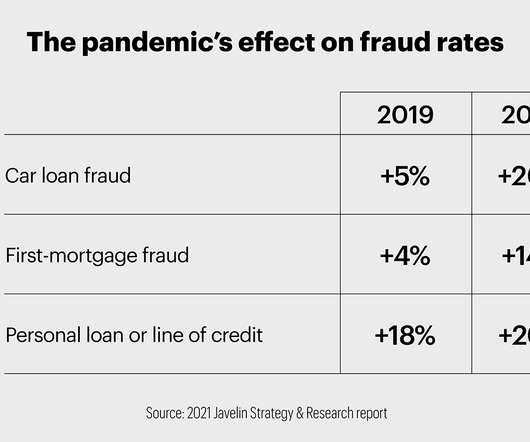

As more customers moved online, fraudsters took advantage of new and increasingly inventive opportunities to commit remote authentication fraud. These types of scams fall under the broad term of remote authentication fraud, and they’re increasingly common—and inventive. Examples of remote authentication fraud. New account fraud.

Let's personalize your content