CRE risk management: Navigating hazards and opportunities

Abrigo

DECEMBER 18, 2023

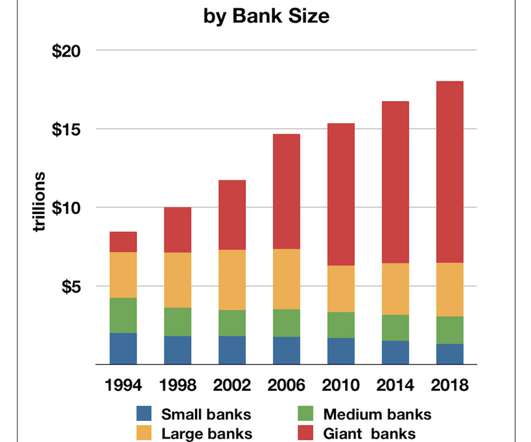

Critical capital Should CRE lending be off the table? Recent headlines may lead bankers to believe that shunning commercial real estate lending is the safest path to limit or avoid credit risk, given stresses on CRE and regulatory concerns. But that might not be the best move for your financial institution or your community.

Let's personalize your content