Payments Providers Combat The Conflict Between Security, User Experience

PYMNTS

JANUARY 14, 2020

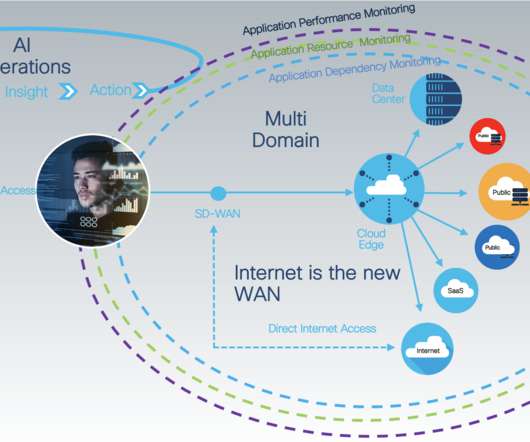

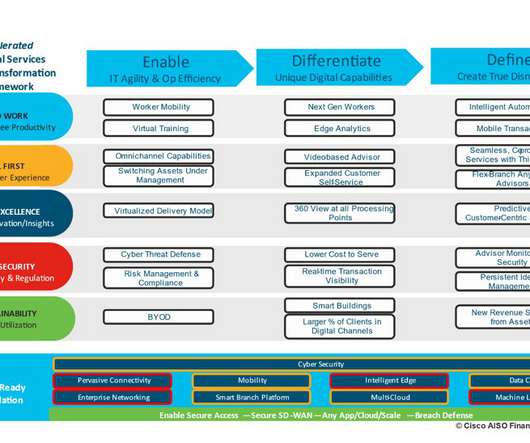

Payments and financial service providers are facing an even greater challenge in balancing these two capabilities in the age of open banking and cloud migrations, with more opportunities than ever before for sensitive company and customer data to be compromised.

Let's personalize your content