10 NBFI AML Compliance Essentials

Abrigo

FEBRUARY 8, 2022

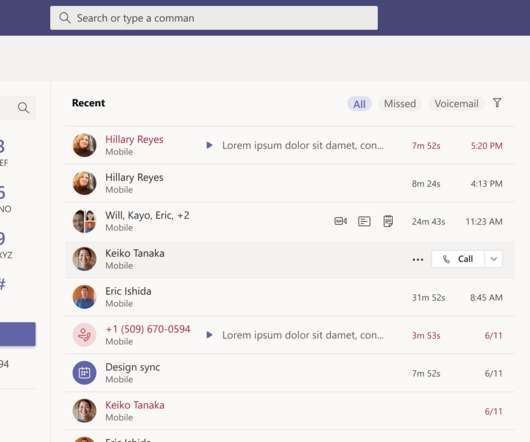

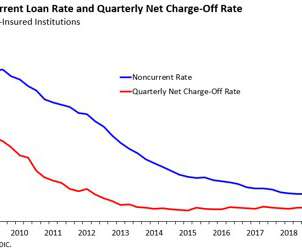

What NBFIs Should Know About Their AML Programs NBFI AML compliance requirements are top of mind in today's regulatory environment. Branch networks and banking hours have been replaced with mobile banking and user experience as important decision criteria in choosing financial relationships. NBFIs’ AML compliance requirements.

Let's personalize your content