The Main Street Rescue That Wasn’t (And Still Isn’t)

PYMNTS

AUGUST 20, 2020

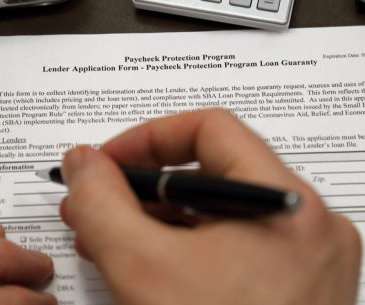

What happens if Main Street becomes less a proving ground for smaller businesses — born of, and serving, local communities — and more a collection of larger firms, well-capitalized, but already enjoying competitive advantages? They are also too large to get funding through programs solely focused on small business lending.

Let's personalize your content