Deposit Profitability – The Operating Cost of Your Deposits

South State Correspondent

SEPTEMBER 30, 2022

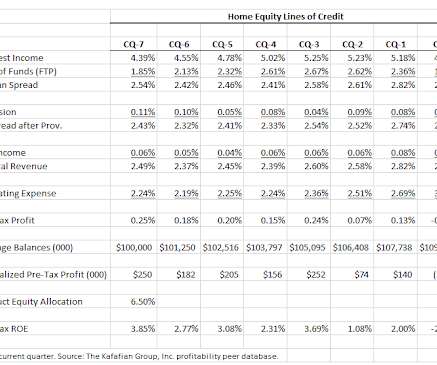

A couple of weeks ago, we delved into the origination and operating costs of manufacturing commercial loans ( HERE ). In this article, we delve into deposit profitability and highlight the cost structure of deposits. Cost of Deposit Sales and Marketing. The final takeaway is that bankers usually spend too much on marketing CDs.

Let's personalize your content