How The Market Gets Interest Rate Predictions Wrong

South State Correspondent

APRIL 22, 2024

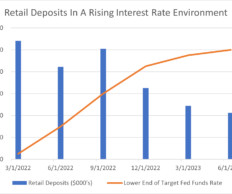

In a few short months, stronger economic data (higher GDP, stronger job market, and stubborn inflation) changed the market’s and the Fed’s view on the future path of interest rates. The market and the Fed are now aligning on only one rate cut in 2024 – obviously this will change over the course of the year as the economic data evolves.

Let's personalize your content