Loan Hedging for Community Banks in 2024

South State Correspondent

JANUARY 10, 2024

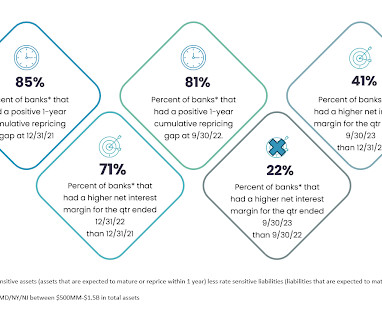

The market expects the current inverted yield curve to remain through much of 2024 (based on long-term interest rates and the expected rate cuts in 2024). This article will discuss how national, regional, and community banks may use loan hedging programs in 2024 to face earnings challenges.

Let's personalize your content