AI Now Helps Banks Manage Compliance

PYMNTS

MAY 23, 2016

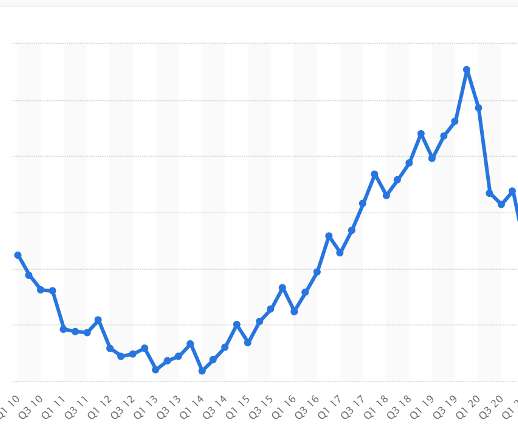

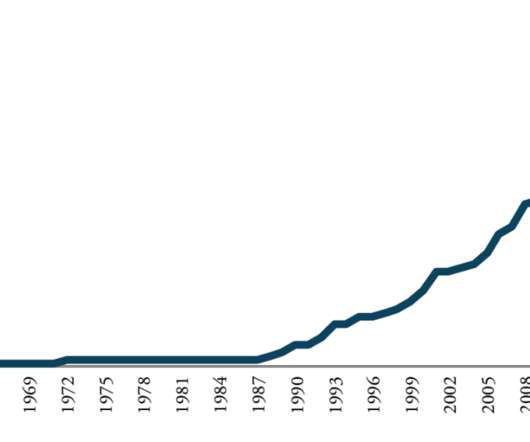

Will artificial intelligence help banks navigate the complexities of compliance more effectively? Against a backdrop where regulations have grown by leaps and bounds in the wake of the financial crisis, The Wall Street Journal reported that banks have taken on tens of thousands of new staffers tied exclusively to compliance.

Let's personalize your content