Managing Interest Rate Risk With a Bank Loan Term Sheet

South State Correspondent

FEBRUARY 18, 2024

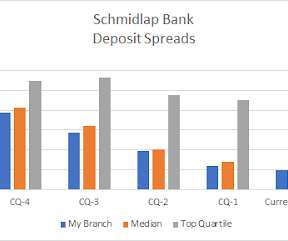

While the loan underwriting is squarely in most banks’ policy guidelines, the loan is highly leveraged, and any increase in expenses or decrease in revenue will create credit stress for the lender and default risk for the borrower. This loan was underwritten to 1.20X debt service coverage ratio (DSCR), 76% loan-to-value (LTV), 9.2%

Let's personalize your content