Safeguarding new banking products from fraud

Abrigo

JANUARY 22, 2024

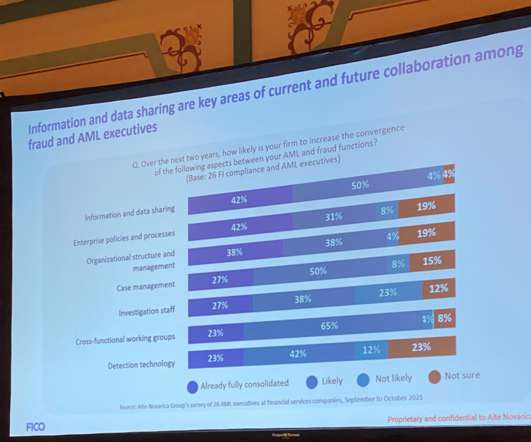

6 Steps t o mitigate fraud risk tied to new products Your AML and fraud teams' input is key when it comes to offering new bank products. You might also like this infographic, "Beyond immediate fraud losses: How the costs and impacts of fraud snowball." download NOW Takeaway 1 Fraud losses totaled $485.6

Let's personalize your content