Traditional FIs Drive Modernization Through FinTech Pairings

PYMNTS

DECEMBER 29, 2020

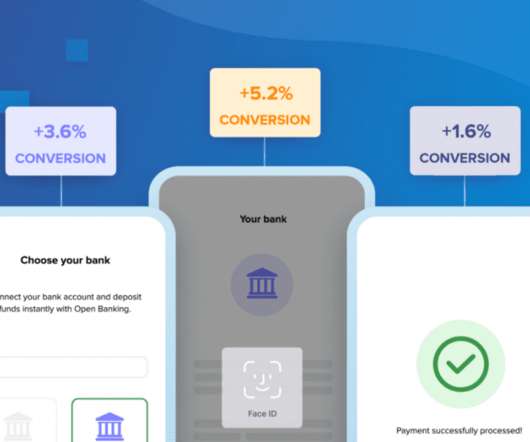

In this week's roundup of bank-FinTech collaboration and open banking initiatives, Citi embraces the unlocking of account data to third-party FinTechs, while WEX weighs in on opportunity for banks to take advantage of partnerships. Plus, one FinTech offers a new spin on the open banking model to drive financial inclusion.

Let's personalize your content